Best Crypto Futures Exchanges in 2023 – Join the Right Platform to Navigate the Volatile Crypto Market

4, August, 2022 • Maxym Aptilon

If you’re looking for the best crypto futures exchange, look no further! In this post, we’ll show you the top exchanges that offer cryptocurrency futures trading.

Crypto futures trading is a great way to speculate on the future price of Bitcoin and other cryptocurrencies. With a leveraged position, you can make big profits – or big losses.

So, what’s the best crypto futures exchange? Here’s a list of the top exchanges:

- Dexilon – Best Decentralized Exchange for Futures Trading

- dYdX – Best Exchange with Creative Trading Tools

- Binance – World’s Largest Crypto Exchange

- Kraken – Best Exchange with Analytics Dashboards

- Bybit – Best Exchange with Various Derivatives

- OKX – The Most Trusted And Secure Exchange

- Phemex – The World’s Leading Phemex Assets Platform

- Gate.io – Leading trading platform

The nominations are based on our research of the platforms. If you’re into learning more about each of them, keep reading.

What is crypto futures: the basics you need to know to understand the process

Crypto futures contracts are a tool that can be used by both cryptocurrency investors and traders to manage risk and speculate on price movements. The value of crypto futures is derived from the cryptocurrency. Below are two most popular examples of utilizing crypto futures to either secure your funds or increase your profits.

Crypto futures can be used to hedge against price risk. For example, if an investor holds a large amount of Bitcoin and is worried about a price decline, they can open a short position in a Bitcoin futures contract. If the price of Bitcoin falls, the investor will make a profit on their short position, offsetting some of the losses from the decline in the spot price.

Crypto futures can be used to speculate on the price of a cryptocurrency. For example, if a trader believes that Bitcoin will rise in value, they could purchase a Bitcoin future with a higher strike price than the current market price. If Bitcoin does indeed rise in value, the trader will profit from their investment.

Understanding what is crypto futures trading and how these contracts work is essential for anyone looking to get involved in the market.

How do crypto futures work – terms, leverages and other characteristics

Crypto futures contracts are similar to other types of futures contracts, in that they are standardized agreements to buy or sell an asset at a specific price at a future date. However, unlike other types of futures contracts, crypto futures are not traded on centralized exchanges. Instead, they are traded on futures trading crypto decentralized exchanges, which use smart contracts to facilitate trade.

Crypto futures contracts can be either long or short. A long position means that the investor expects the price of the underlying asset to increase, while a short position means that the investor expects the price of the underlying asset to decrease.

Crypto futures trading platforms are typically traded on a leverage basis, meaning that traders can control a larger position than they would be able to with the underlying cryptocurrency. For example, if a trader has $1,000 to invest in Bitcoin, they can purchase 10 Bitcoin futures contracts with 5x leverage. This allows the trader to control $50,000 worth of Bitcoin, magnifying both profits and losses.

How to trade crypto futures to make sure you win, not lose

Crypto futures offer a way to trade cryptocurrency prices without having to actually own the underlying coins. It can be done on several different exchanges, and often allows for leverage, which can amplify gains (and losses).

You can buy contracts that bet on the price going up, or sell contracts if you think the price will fall. These contracts are traded on margin, meaning you only need to put down a small amount of money to open a position.

Before trading crypto futures, it’s important to understand the risks. It’s important to be aware of potential price manipulation by large traders, as this can impact the market. However, if you’re careful and do your research, crypto futures can be a great way to make money in the cryptocurrency market.

One of the crucial things to consider is also the crypto futures trading exchange you’ll be using to buy crypto futures or sell them. There are a number of factors you should look at before choosing the platform that fits you best and the most important of them will be described below.

Best crypto futures trading platform – consider the following criteria to choose the right one

The best crypto futures trading platform is one that offers a variety of features and tools to help you trade effectively. Cryptocurrency futures exchange should also be easy to use and navigate, so you can focus on your trading. Some important features to look for in a crypto futures trading platform include:

- Trade execution. The platform should allow you to place trades quickly and easily. This means, the website is not complicated to navigate and is not overloaded with unnecessary information, obvious guides or features nobody uses. The simpler, the better the chance you’ll be focused on the most important thing – trading crypto futures.

- Charting tools. Trading platforms should offer a variety of charts to help you analyze the markets when needed. Look for platforms that offer a variety of indicators and drawing tools, so you can customize your charts to suit your trading style.

- Security. Make sure the platform is secure, so you can trade with peace of mind. Signing up for a decentralized exchange will secure your funds from being stolen by cyber criminals, since your money won’t be stored on the platform. Also, as we mentioned earlier, DEXs use smart contracts which is a game changer for secure trading.

- Solid customer support. In case you have any questions or issues, the platform should offer customer support, so you can get help when you need it. This is clearly an underrated feature because usually when we sign up, we don’t think that something bad will happen.

By choosing a platform according to the abovementioned criteria, you can trade futures with confidence.

Crypto futures exchanges – TOP 8 platforms that proved to be reliable in rough 2023

There are so many bitcoin futures trading exchanges on the market that you won’t be able to even explore all of them within months. We did our research on the best crypto futures exchanges so that you didn’t have to and narrowed down the list to the five of them. Feel free to choose the one you like most.

| Platform | Coins | Leverage | Fees |

|---|---|---|---|

| Dexilon (Testnet version) | 10+ | 10х | 0 gas cost, 0.1% rebate for maker and 0.05% for taker that can be reduced to 0.015% |

| dYdx | 40+ | 20X | 0.1% |

| Binance | 200+ | 20X | 0.02% – maker 0.06% – taker |

| Kraken | 100+ | 50X | 0.16% and up |

| Bybit | 400+ | 100X | 0.01% – maker

0.05% – taker |

Being a new player on the market, Dexilon has been showing great results over the past 12 months, including steady updates of the Testnet and security audit by Hacken. It has a lot more on the 2023 roadmap, like expanding the range of trading pairs and available features.

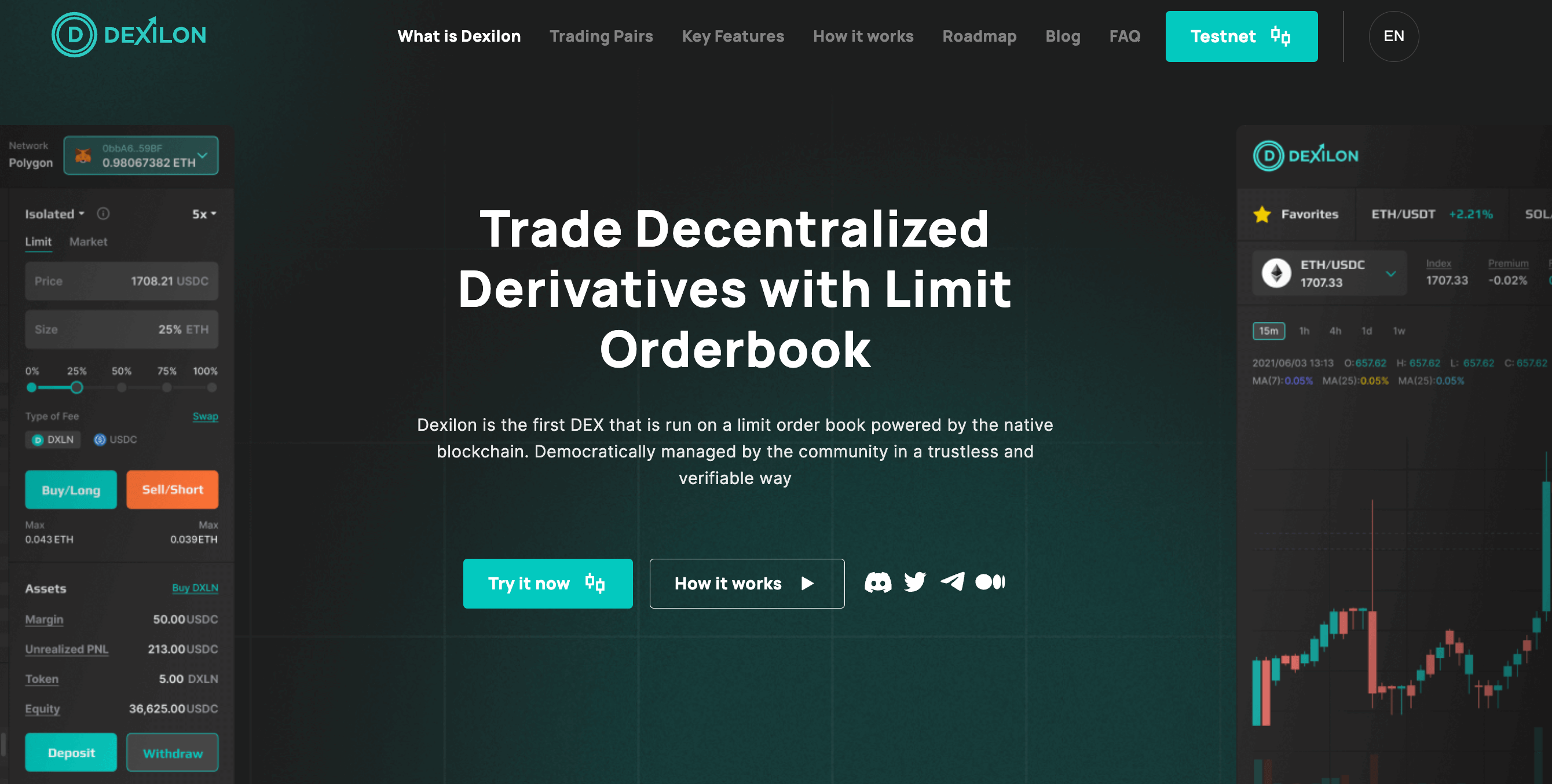

#1 Dexilon

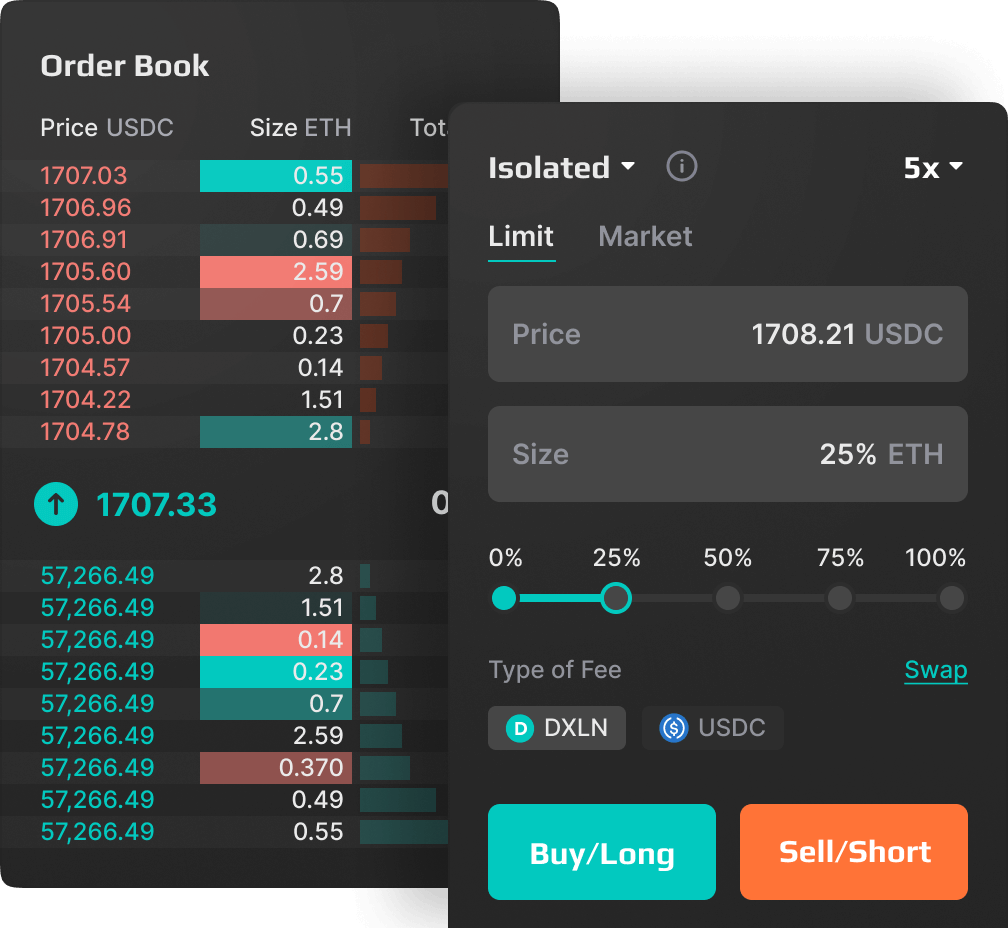

With Dexilon, a new decentralized yet very promising crypto futures venue, you will be able to enjoy the biggest benefits of centralized crypto futures exchange, like low latency order execution and probably the most competitive fees, like 1bps rebate for maker and as low as 1.5 taker fee. In addition, order requests are gasless for the user, while custody and trade registry and risk management is conducted on custom built blockchain. One of the attractive feature is the Dexilon token, which has very powerful tokenomics and deflation. Last but not least, the team is working on the development of a highly advanced data terminal in-built into the exchange, which is meant to help users make better trading decisions, on the sophisticated yet user-friendly indicators and charts.

Pros

- Self custody with personal cryptocurrency wallets

- A variety of crypto derivatives in addition to futures

- Low latency order execution

- No KYC or verification needed

- Testnet for a risk-free crypto futures experience

Cons

- A smaller number of coins to trade

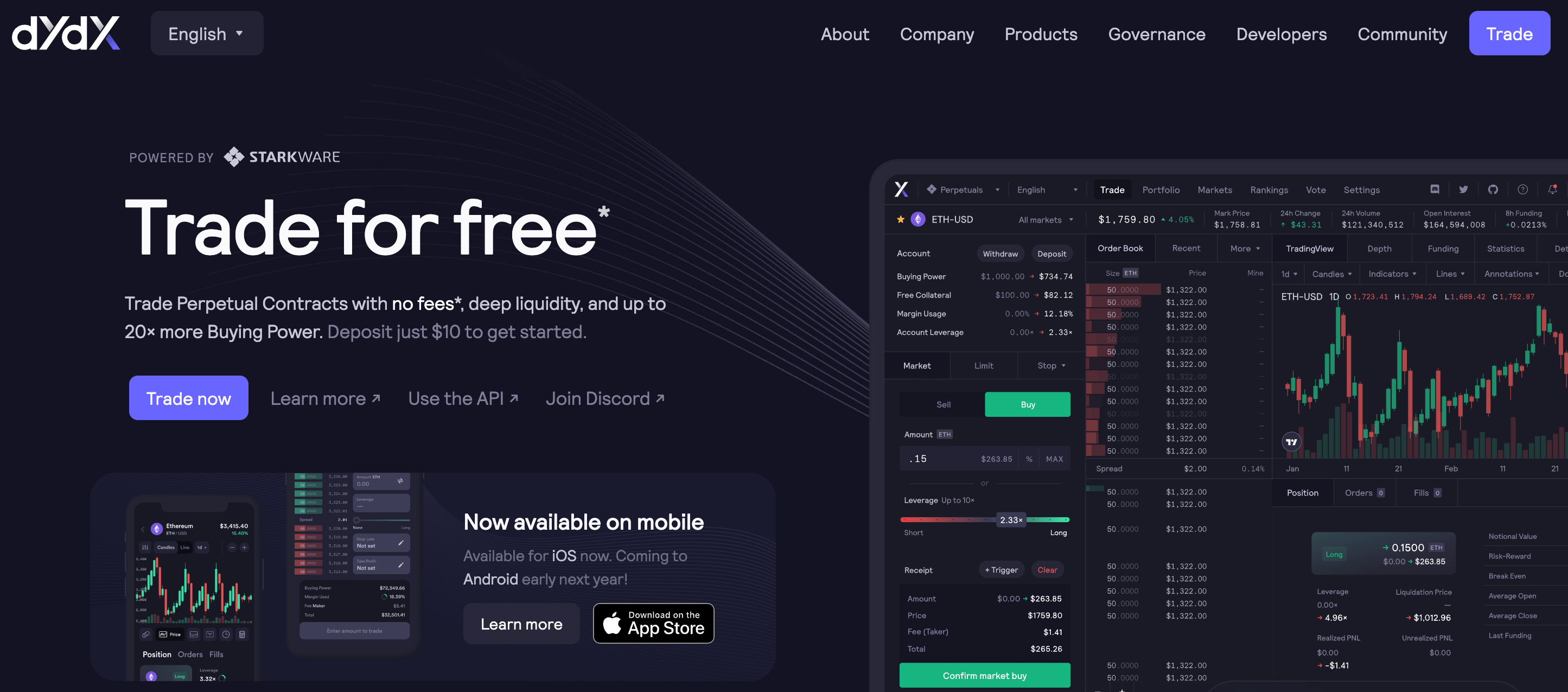

#2 dYdX

dYdX is the second on our list, and it’s a quite interesting platform because it’s using crowdsourced liquidity. It means that while opening a leveraged trading position on the platform, you’re borrowing from the decentralized liquidity pool consisting of the funds deposited by dYdX’s traders. The platform’s exchanges are built on trustless protocols extensible with no need to get any permissions. Users also get access to perpetual trading options, NFT collections and a testnet to experiment and find more creative ways to earn crypto.

Pros

- Crowdsourced liquidity

- DEX with no KYC

- Good trading volumes

Cons

- Not a fully intuitive platform for new traders

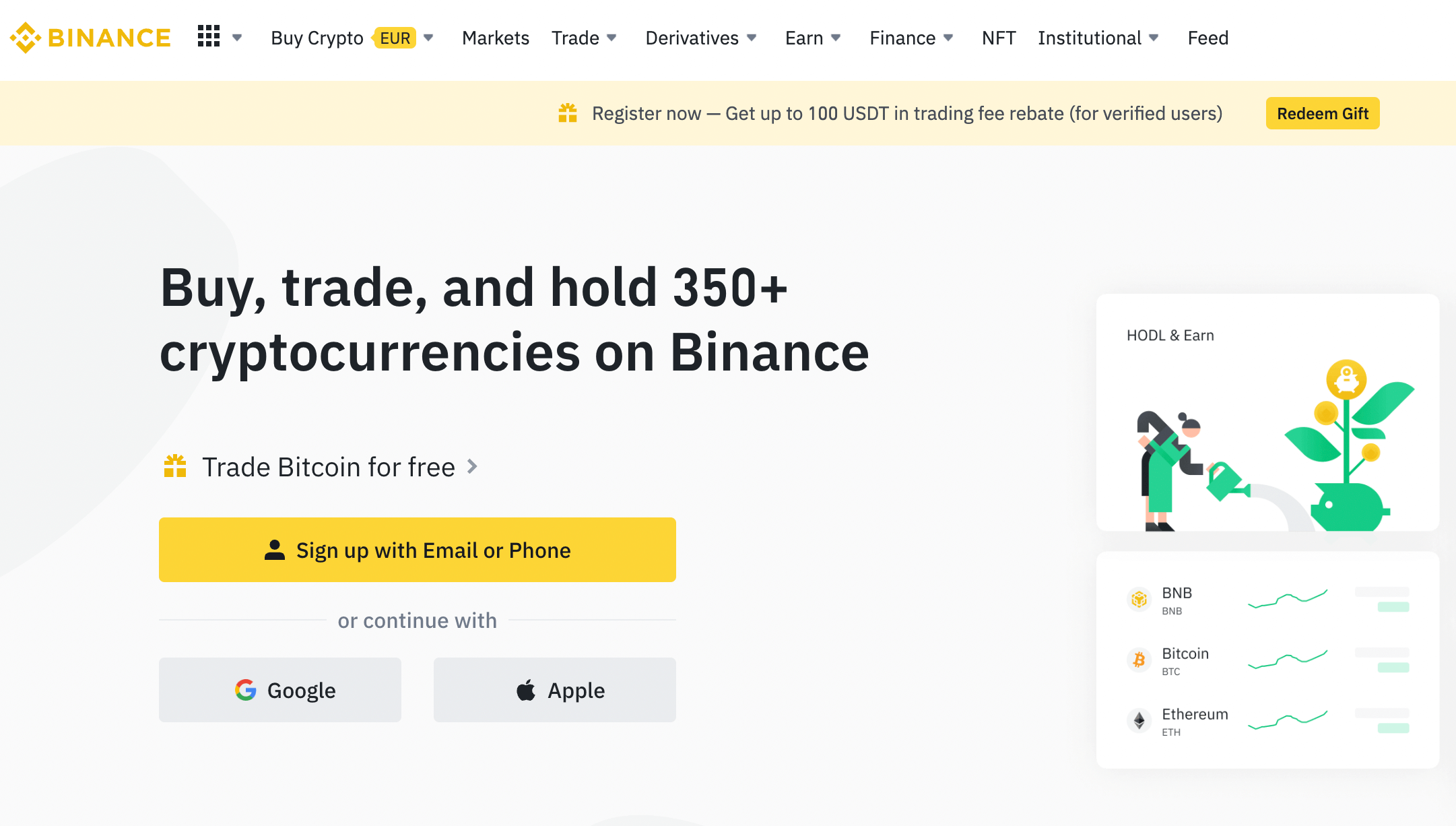

#3 Binance

Even those who have never traded crypto, have heard about Binance, so it’s inevitably one of the best crypto exchanges for futures. And that’s well-deserved, given its variety of crypto assets combined with great liquidity. Binance provides its users with two types of futures: USD-Margined Futures Contracts and Coin Managed Futures Contracts. What’s more, the platform offers 10% off their trading fees for those who use BNB to pay for the fees on the exchange.

Pros

- Good liquidity

- Wide variety of crypto assets

Cons

- Centralized exchange which means lower trust of users

- Some regulatory unclarities

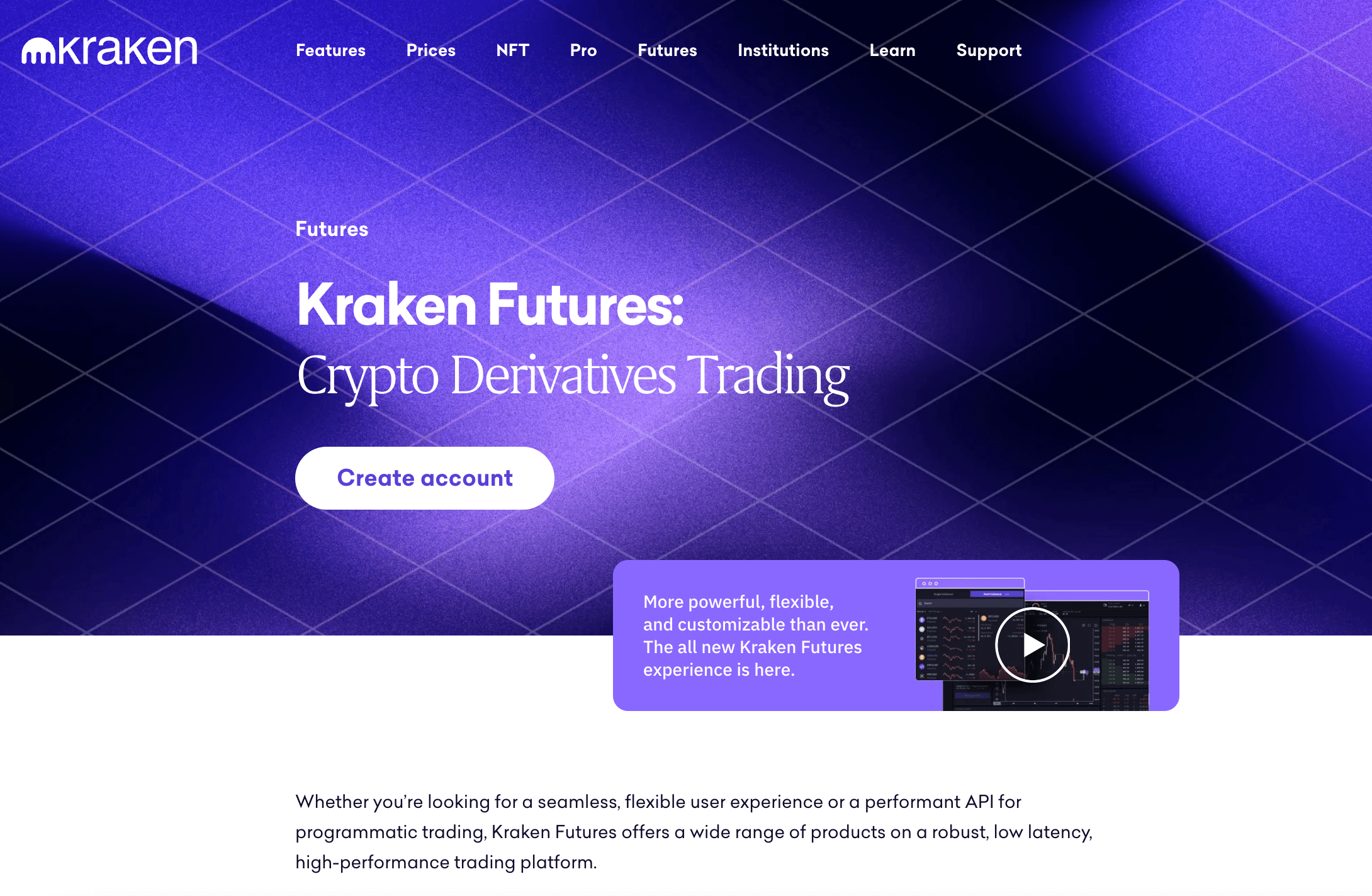

#4 Kraken

Based in San Francisco, Kraken allows you to trade around 200 cryptocurrencies. Kraken has two platforms – their main trading exchange and Kraken Pro that offers traders with higher volumes much lower fees. Kraken Pro also provides users with highly customizable dashboards and other analytical tools so that you could make informed decisions. Other than that, even the main trading platform is quite rich in features, including derivatives and futures. However, it the fees are quite high compared to the Pro version.

Pros

- Advanced trading platform with great selection of products

Cons

- High fees compared to other exchanges

- High trading minimal

#5 Bybit

Bybit offers more than 400 assets for trading and has over 10 million users all over the world. It can boast its offering of advanced matching capabilities, multilingual support and great customer service.

Most importantly, though, Bybit provides several types of futures contracts, like USDT perpetuals, inverse perpetual and futures.

Pros

- No KYC or verification needed

- A huge variety of coins to trade

Cons

- Not available in the US

- Known for personal data security issues

#6 OKX

OKX is a reputable cryptocurrency platform and futures exchange that offers a wide range of trading options, including bitcoin futures trading. As one of the leading crypto futures trading platforms, OKX provides users with the opportunity to engage in cryptocurrency futures trading. With its advanced matching capabilities and multilingual support, OKX has established itself as a reliable platform for traders seeking to participate in the dynamic world of crypto futures trading. However, it is important to note that OKX is not available for users in the United States. Despite its past concerns regarding personal data security, OKX remains a popular choice among traders looking for a robust cryptocurrency futures exchange.

Pros

- Offers a diverse selection of over 400 cryptocurrencies for trading

- OKX provides various types of futures contracts, including bitcoin futures trading

- OKX offers multilingual support

Cons

- OKX is not available for users in the United States or Canada

- Personal data security concerns

- A steep learning curve

- Instances of delayed user support

#7 Phemex

Phemex is a well-regarded cryptocurrency futures exchange and trading platform that caters to users seeking bitcoin futures trading and other crypto futures trading options. With its robust features and user-friendly interface, Phemex has established itself as one of the prominent crypto futures trading platforms in the market.

Pros

- Pemex is known for its lightning-fast trading execution and low latency

- An intuitive and user-friendly interface

- It is lauded for its responsive and helpful customer support

Cons

- Limited asset variety of cryptocurrencies and trading pairs

- Phemex has fewer payment options compared to some other platforms

- Limited regional availability

- The platform does not support direct fiat deposits or withdrawals

#8 Gate.io

Gate.io is a leading cryptocurrency futures exchange and trading platform that offers a comprehensive suite of features for bitcoin futures trading and other crypto futures trading activities. With a focus on user satisfaction and security, Gate.io strives to provide a reliable and user-friendly trading experience.

However, users should take note of the limited fiat support, potential delays in customer support response times, and the availability of educational resources when considering the platform for their trading needs.

Pros

- Ample choices of trading experiences

- Bitcoin features trading

- Robust security measures

- Intuitive and user-friendly interface

- Competitive fee structure

Cons

- Limited fiat support

- Low customer support response rate

- Limited educational resources base

Crypto futures trading – a step-by-step guide for beginners

Choosing a top platform for crypto derivatives is essential not only for security and profit benefits, but also for a simple, no-frill trading experience. Decentralized platforms are more compelling for crypto traders because you most likely won’t need to go through the multi-step verification process that is required by the CEXs.

- Connect your wallet (currently you can add a MetaMask or a Binance wallet)

- Deposit funds by multiple methods of payment

- Buy and sell futures from the available trading pairs

- Track your position using simple and clear infographics

Even though the crypto world might seem overwhelming, especially at the beginning, trading should necessarily be complicated. Focus on the analysis of assets and their historical data to make an educated decision instead of trying to figure out how to trade on a complicated platform.

Conclusion

Eventually, futures trading is not generally for beginners since you have to understand the risks and be well-versed in the available strategies. However, if you’re new to crypto and look for alternative ways of boosting your wins, don’t feel discouraged. Just take some time to observe the market and get acquainted with the trends in crypto over the last couple of years. Lastly, even though the temptation to earn more might be strong, remember the general rule: don’t risk more money than you can afford to lose.

FAQ

-

What is crypto futures trading?

Crypto futures trading refers to the practice of buying or selling contracts that speculate on the future price of cryptocurrencies. It allows traders to profit from price movements without owning the actual underlying assets. Traders enter into futures contracts that stipulate the price and date for the delivery of the cryptocurrency at a future time.

-

How do Bitcoin futures work?

Bitcoin futures work by allowing traders to speculate on the future price of Bitcoin. Futures contracts set a predetermined price and date for the delivery of Bitcoin. Traders can take either long (buy) or short (sell) positions based on their predictions of future price movement. Profits or losses are realized based on the difference between the contract price and the actual market price at the time of contract expiration.

-

What is the best cryptocurrency for futures trading?

The best cryptocurrency for futures trading can vary depending on individual trading preferences and market conditions. However, Bitcoin (BTC) is often considered the most popular and widely traded cryptocurrency for futures trading due to its high liquidity and market dominance. Other cryptocurrencies such as Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) also have active futures markets and can be suitable for futures trading.