10 Best Decentralized Exchanges for Crypto Trading

18, April, 2023 • Maxym Aptilon

Before we dive into answering the question “What is the best decentralized exchange?”, let’s take a quick look at what a crypto exchange is and how it works. Just scroll down to the next section, if you’re already well-versed in that topic.

A cryptocurrency exchange is a platform where you can buy and/or sell crypto assets, like BTC or DOT. You might have had some experience with regular trading platforms, and crypto exchanges function quite similarly to them. Some exchanges offer advanced trading features like derivatives trading. For example, Dexilon provides its users with the ability to trade crypto options, crypto futures, and also some exotic derivatives.

Here’s a list of the TOP decentralized exchanges:

- Dexilon – Best DEX for Crypto Derivatives

- Bisq – Best DEX for Smaller Trades

- dYdX – Best Exchange for Margin Trading

- PancakeSwap – Best DEX for New Crypto Assets

- Uniswap – Largest Decentralized Exchange

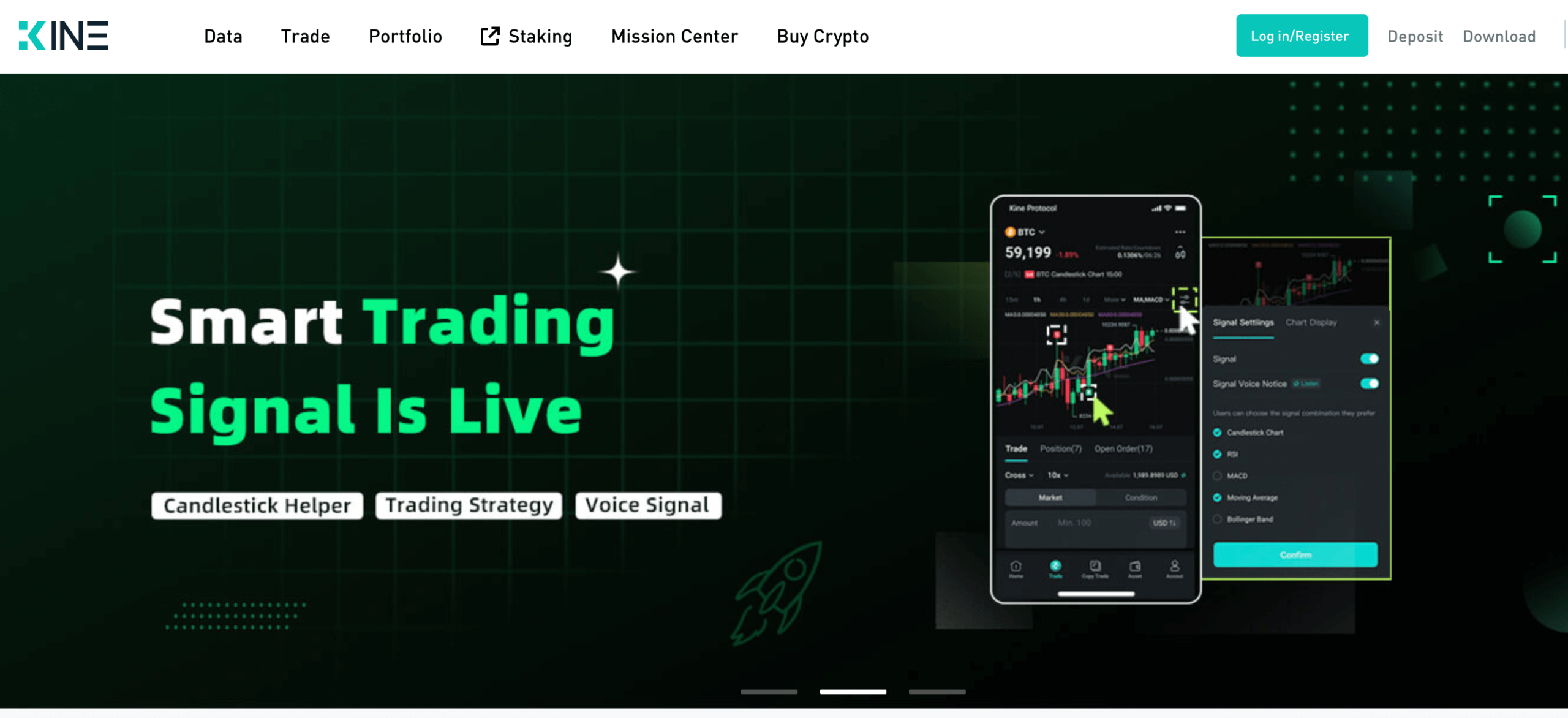

- Kine Protocol – Best Exchange for Low Prices

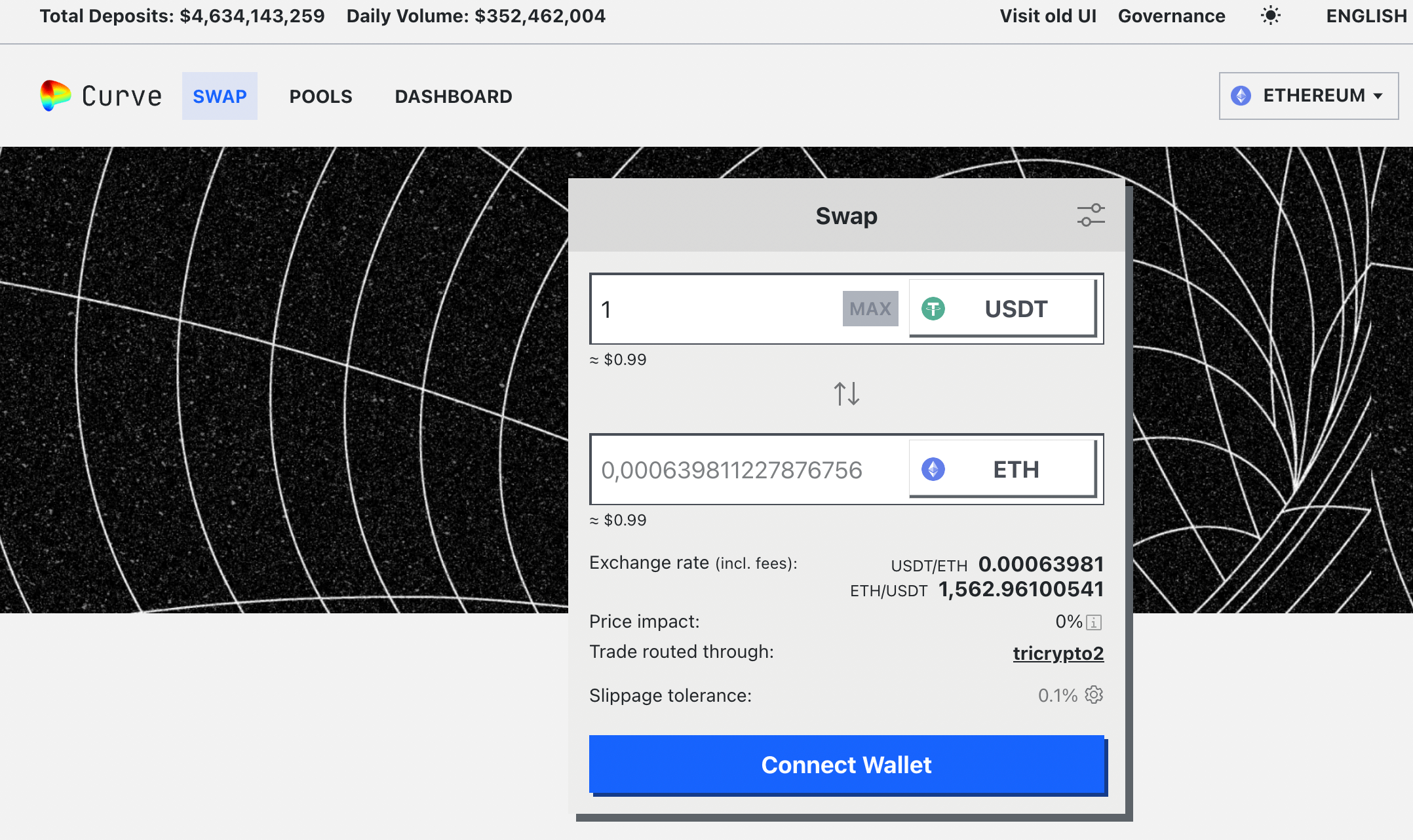

- Curve Finance – Best DEX for Stablecoins

- DODO – Best Proactive Market (PMM) Maker Exchange

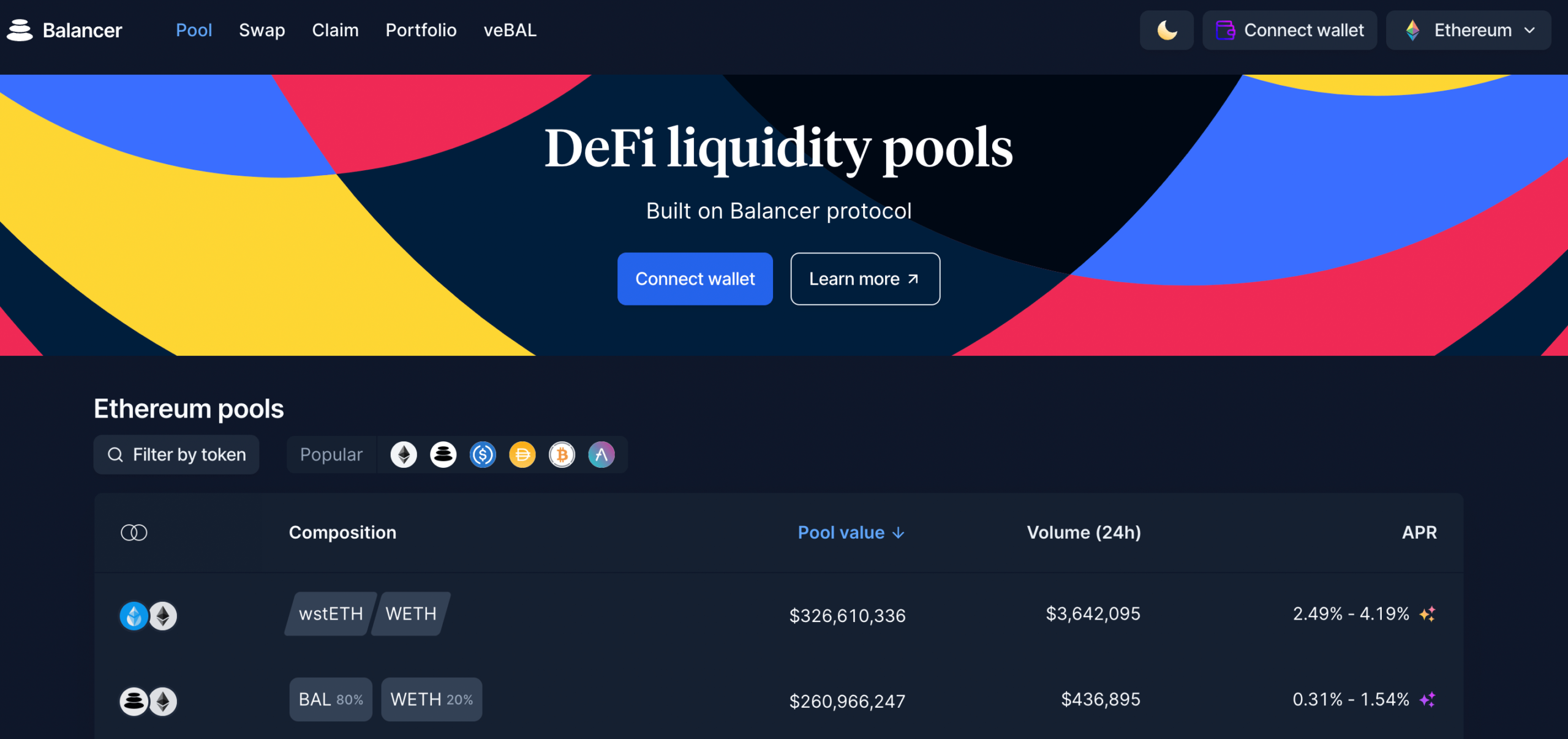

- Balancer – Best Flexible DEX

- Apex Protocol – Best New DeFi Platform

If you wonder what are the types of crypto exchanges, there are roughly two of them – centralized and decentralized exchanges, and we’re going to focus on the second one in this article. But let us describe both of them briefly to compare.

Best decentralized Bitcoin exchanges – is it better to choose a DEX or a CEX?

This part might not be helpful for those who have already decided on either of the two types of crypto exchanges, but if you still try to decide if you should choose the best decentralized bitcoin exchange or the best centralized one, here are the main distinctions between them.

Centralized exchanges (CEXs) are controlled by an organization. One of the biggest advantages of centralized exchanges is that they allow users to trade their fiat currency like EUR or USD into crypto assets.

As a user of the CEX, you will have to go through the KYC (Know Your Customer) process. This means that before you get to exchange your crypto, you will have to get verified by the platform which involves providing them with your personal information, like your address and ID details. This KYC policy is aimed at tackling cyberattacks and securing everyone’s assets. However, the money being held by a centralized entity inevitably puts it at risk of being stolen by hackers.

These days, the majority of crypto trading transactions are being performed on centralized exchanges. Primarily because this type of exchange appeared first. However, it has some disadvantages, including security issues, which became the reason why decentralized exchanges appeared on the market over time.

Decentralized exchanges (DEX) are much more autonomous than centralized exchanges. They run on smart contracts, and computer protocols that execute, control, and document transactions under specific circumstances. DEXs allow anonymity and flexibility for users since there are usually no KYC requirements.

When you hold your crypto on a centralized exchange, it takes control of your funds. With the DEX though, you stay in control of your assets and, thus, this is considered a safer way to trade crypto. With most DeFi exchanges, you trade directly from the wallet connected to the platform. One of the biggest downsides of decentralized exchanges is that you won’t be able to exchange your fiat currency for crypto, so you need to hold some crypto in your crypto wallet, like MetaMask before you try to exchange it for the other currency on the platform.

Let’s proceed to learn about the biggest benefits of the best decentralized exchanges.

Best decentralized crypto exchanges – what are their advantages?

Best decentralized cryptocurrency exchanges have several benefits that make them more and more attractive to users. Take a look at the list below.

- The range of assets available. One of the biggest perks of DEXs is that you usually get access to a tremendous number of coins. It’s much easier to add new coins to a decentralized exchange, as centralized ones require going through a complicated verification process. So new coins usually emerge much faster on decentralized exchanges and before this coin grows in price, you can be one of the lucky dogs, who gets it for a very reasonable price.

- Anonymity and better privacy. DEXs usually don’t follow a KYC protocol, so you do not need to submit your personal data to a decentralized exchange, so your data won’t be stolen or violated.

- Much lower fees. The exchange does not hold your assets as an intermediary, which means that there’s less work involved on their side, so the fees are usually lower.

Decentralized exchanges were created as a response to the restrictions of the centralized ones and made them available to a wider audience of crypto enthusiasts and, despite their own limitations, they are gaining more popularity. Since there’s a huge number of decentralized exchanges these days, you need to know the most important criteria to choose the best dex cryptocurrency exchange available on the market. Keep reading to learn more.

Best DEX exchanges – the criteria for choosing a perfect platform you won’t regret joining

When choosing the best dex crypto exchanges, you need to be aware of what you should be looking at. To be able to separate the wheat from the chaff, there are roughly 7 factors you need to check to make sure the platform is reliable and legit. You are free to prioritize them depending on your needs and preferences.

- Fees and their transparency. Fees are never a pleasant thing, but they are deeply frustrating if they eat up a lump sum of your rewards. So make sure you study the fees of the exchange you’re choosing before you invest any money. If the platform doesn’t openly describe its fees, it’s automatically a red flag – you came to DeFi for transparency, didn’t you?

- Security. Even though your money is not held by the exchange, it’s essential to choose an exchange that takes safety seriously. Cybercriminals are evolving along with security measures, so choose an exchange that uses the latest and most reliable achievements of security software.

- Supported coins. If you’re into trying new assets, and it’s important for you to be able to trade a wide range of cryptocurrencies, you should look for a platform that supports a wide range of coins. However, if you’re one of those who prefer to let others test the waters, and usually stick to the trusted assets, choose any of the five exchanges below, they have more than enough.

- Payment methods. It’s important when you can buy crypto using a convenient way of payment. Especially, if you’re new to crypto, it’s important to have at least a small area where you know what to do and how to do it. So look for an exchange that supports the most suitable payment method personally for you.

- Customer service. Seems like one of the least important factors on the list, but, believe me, you don’t want to have an indifferent person on the line or, which is even worse, didn’t get any response when you have some issues with your transactions.

- Customer reviews. I doubted if I have to write it because that’s what you’re doing right now – gathering information and trying to figure out what is the best decentralized exchange for crypto. But you can go one step further. For example, type in Google “best decentralized exchange Reddit” to read the real discussions of the crypto enthusiast who tried different exchanges and chose the one.

And now the moment came – we’ll break down 5 crypto DEXs and let you define your best decentralized exchange for crypto. They all have their benefits and downsides, so as I’ve written earlier, we can’t decide which one suits your needs best – you’ll need to do it on your own.

Best decentralized exchange to buy crypto

We’ve studied the market and prepared a list of 10 exchanges that are worth trying. Some crypto traders prefer to trade on several platforms, while others choose their best dex exchange to buy crypto and stick with it. Take a look at the best bitcoin exchanges we’ve studied and choose according to your needs.

| Platform | Fees | Tokens | Min trade | Overall impression |

|---|---|---|---|---|

| Dexilon | 0 gas cost, 0.1% rebate for maker and 0.05% for taker that can be reduced to 0.015% | over 10 | n/a | The best new crypto derivatives exchange on the market with no gas costs |

| Bisq | from 0.1% to 0.70% transaction fee | over 120 | n/a | An exchange with a wide range of payment methods and coins |

| PancakeSwap | 0.25% transaction fee | over 50 | n/a | A great exchange for new cryptocurrencies |

| dYdX | 0% for trading volumes of less than $100,000/mo | over 35 | n/a | A perfect crypto exchange for margin trading |

| UniSwap | 0.3% fee on transactions + gas fee | 18 | n/a | Great exchange with unlimited liquidity and a lot of bonuses |

| Kine Protocol | maker fee is 0.02% and the taker fee is 0.04%. Fees depend on trading volumes | over 400 | n/a | The largest DEX on the market |

| Curve Finance | fees range from 0.04% to 0.4%, depending on the trading pair and liquidity | over 8 | n/a | Offers multiple liquidity pools |

| DODO | 0.3% flat fee on trades | 11 | n/a | PMM algorithm wth efficient on-chain liquidity for Web3 assets |

| Balancer | a flat fee of 0.3% for both maker and taker transactions. Withdrawal fee is 0.05% | 52 | n/a | Flexible exchange with numerous options for passive income |

| Apex Protocol | a flat fee of 0.2% for both maker and taker transactions | 5 | n/a | A wide range of DeFi features, but a limited number of supported coins |

-

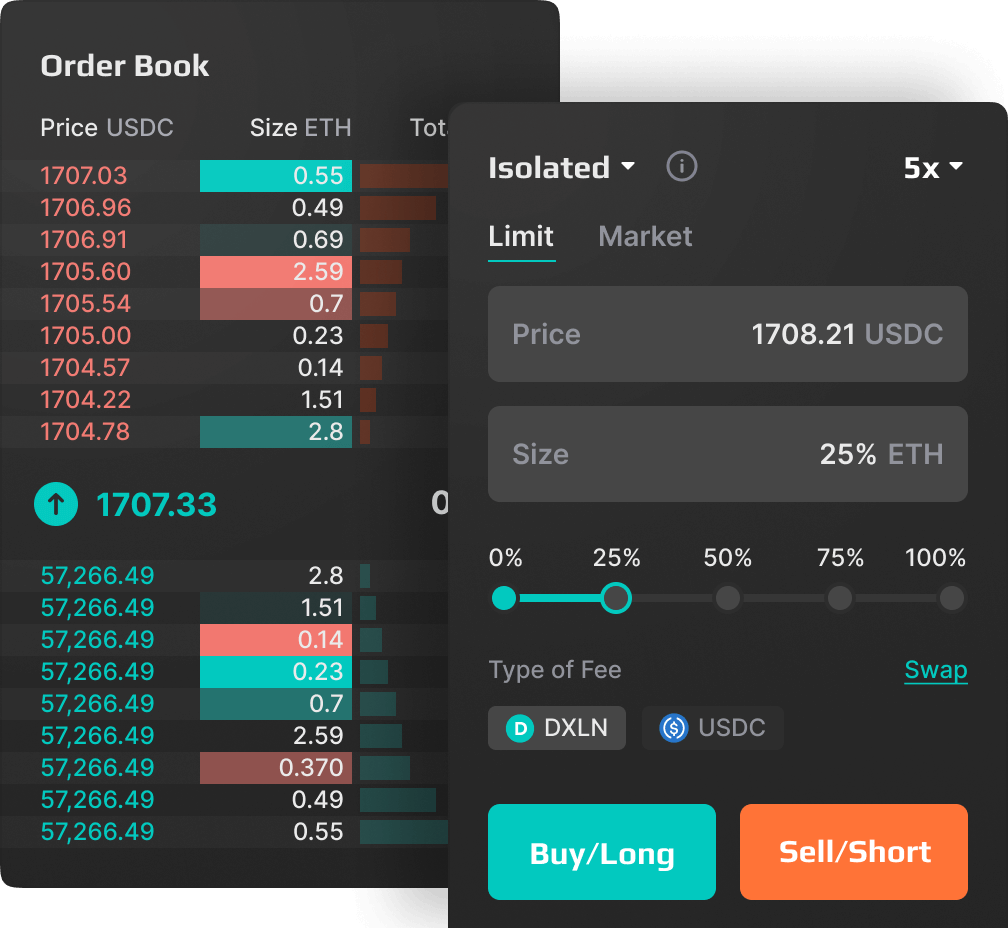

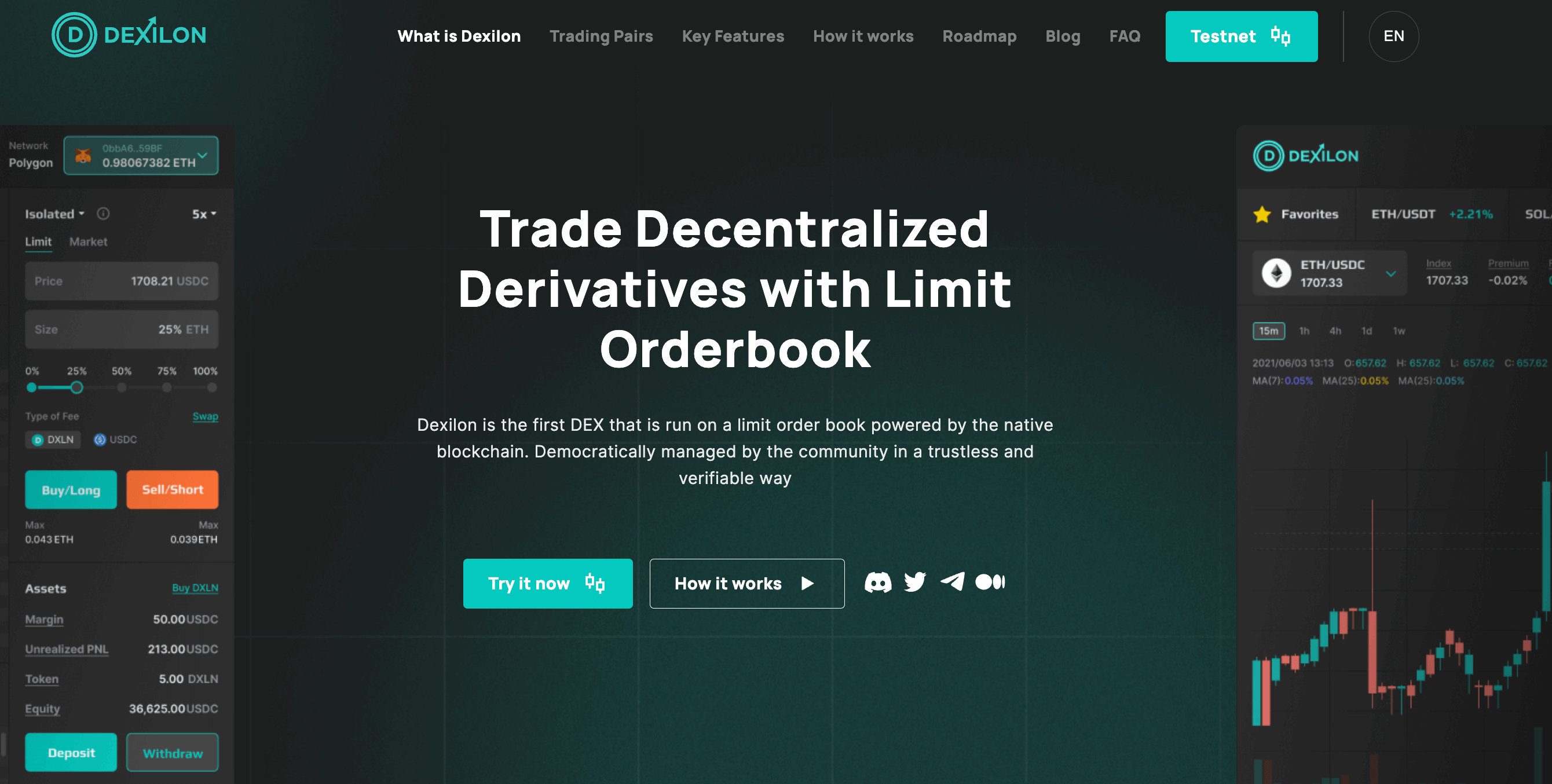

Dexilon

With Dexilon, you’ll be in control of your assets, since the platform will not store them – they will be kept in a smart contract linked to your self custody crypto wallet, like MetaMask. Dexilon offers very competitive fees, primarily because there are no gas costs. Economic model. Data providers and oracle node validators will be compensated from a portion of a taker fee. The taker fee ranges from 1,5 to 5 bps, whereas there is a rebate of 1 bps. 20% of this difference is an oracle reward. If we take a median of 3 bps, the oracle will receive 0,4 bps (3-1)*20% of a taker fee. These rewards are accumulated on the Dexilon chain and are redistributed every 8 hours.

Dexilon oracle requires a set of nodes that will validate the data collected from data providers. For this, this chain will get 30% of the rewards. The rest will go to data providers.

Another cool thing about this exchange is that they also provide the users with the chance to learn about how the exchange works without investing a single Bitcoin – a Testnet they launched recently, despite not being packed with multiple features, teaches you the basics. What’s more, Dexilon is also considered one of the best crypto derivatives exchanges – read a full review to learn about it. Overall, you’ll be able to trade crypto on a safe platform with no KYC requirements and roof-breaking fees.

Pros- Self custody with personal cryptocurrency wallets

- A wide range of liquid crypto derivatives in addition, including

Cons

- Relatively new and less-known

- Testnet for a risk-free crypto futures experience

- Liquidity incentives and gasless trading

-

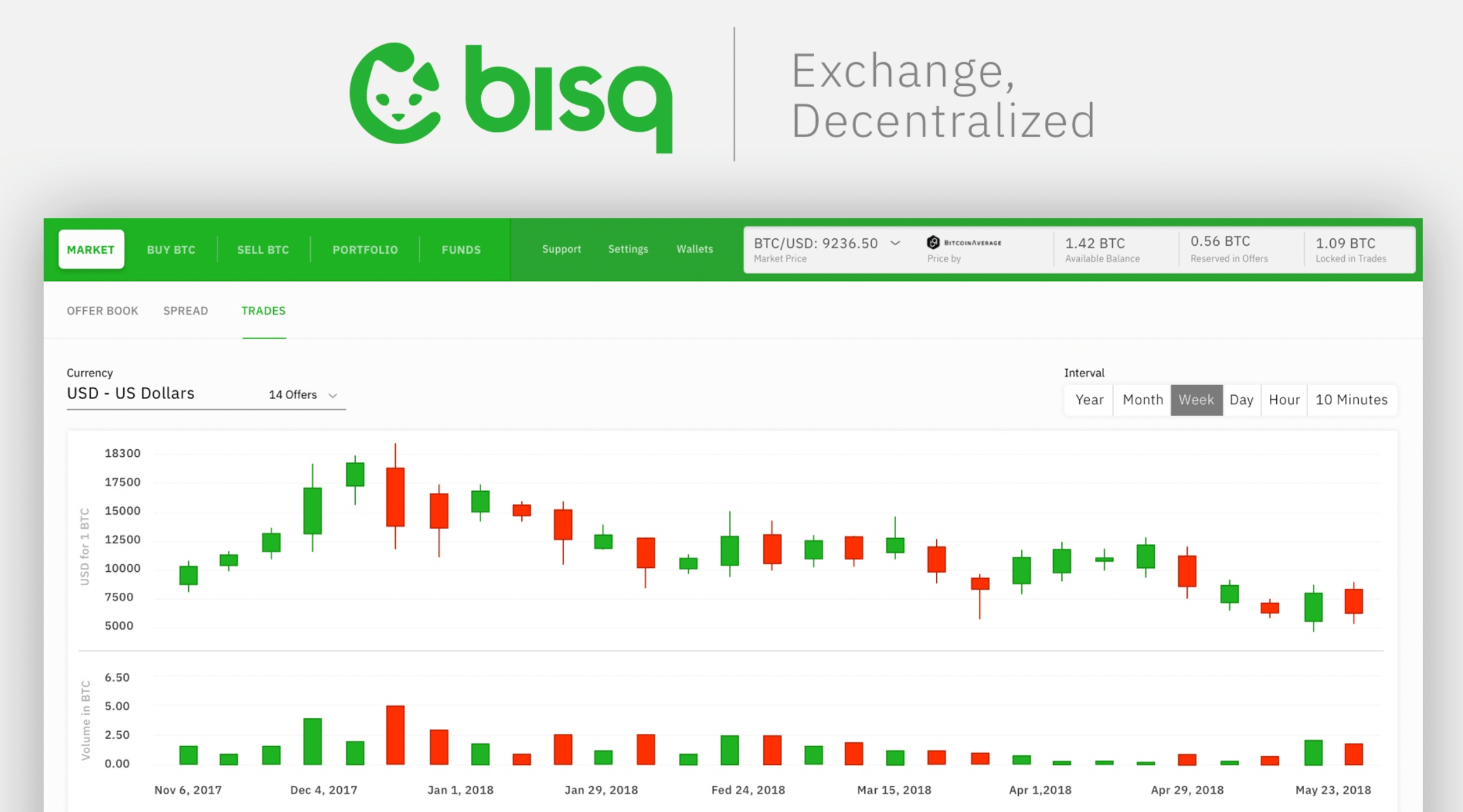

Bisq

Bisq is a decentralized exchange available globally. Similarly to Dexilon, it has no KYC and offers a great degree of privacy. It’s been on the market for more than 8 years and offers a wide range of crypto assets (currently more than 120). The number of payment methods is also great, starting from traditional bank wire transfers to cash deposits and even more. The exchange is targeted at making smaller trades which can deter some users, but it’s a great option for those who prefer trading anonymously on a DeFi platform with no KYC and a good choice of tokens.

Pros

- Wide range of coins

- No KYC needed

- Instant approval for withdrawals

Cons

- Trading fees are above average

- The app is pretty basic

-

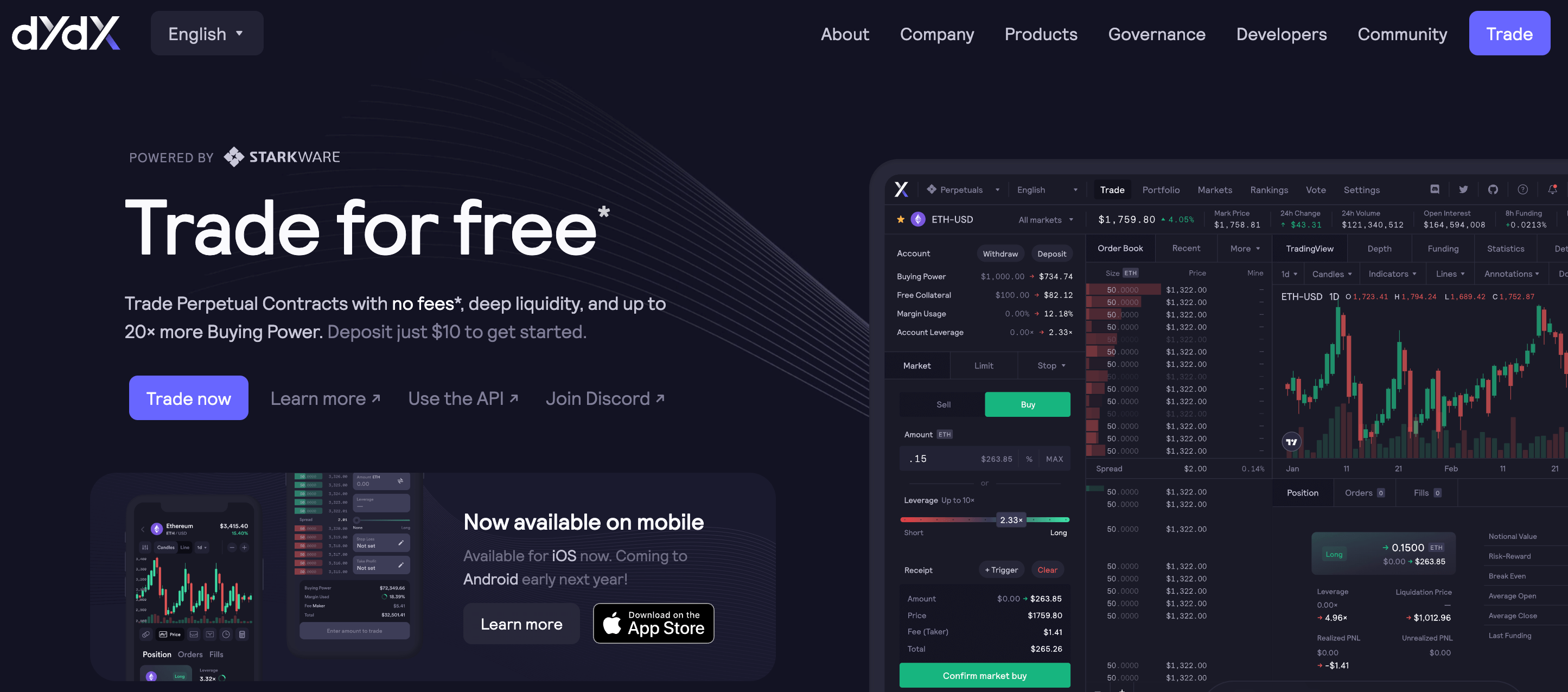

dYdX

dYdX has a reputation as one of the groundbreaking crypto exchanges for margin trading and crypto derivatives. Due to the great funding ($87 million) from the very foundation of the exchange in 2017, the dYdX team managed to work on great financial technologies for crypto trading. For example, it’s a first-of-its-kind crypto derivatives exchange that focuses exclusively on crowdsourced liquidity. This means that when you deposit collateral in order to open a leveraged trading position, you’re borrowing funds from a liquidity pool that consists fully of the crypto deposited by traders.

Pros- No gas costs are charged

- Ease of use – well-thought UX

Cons

- Limited number of trading pairs

- Deposits and withdrawals are only in crypto

-

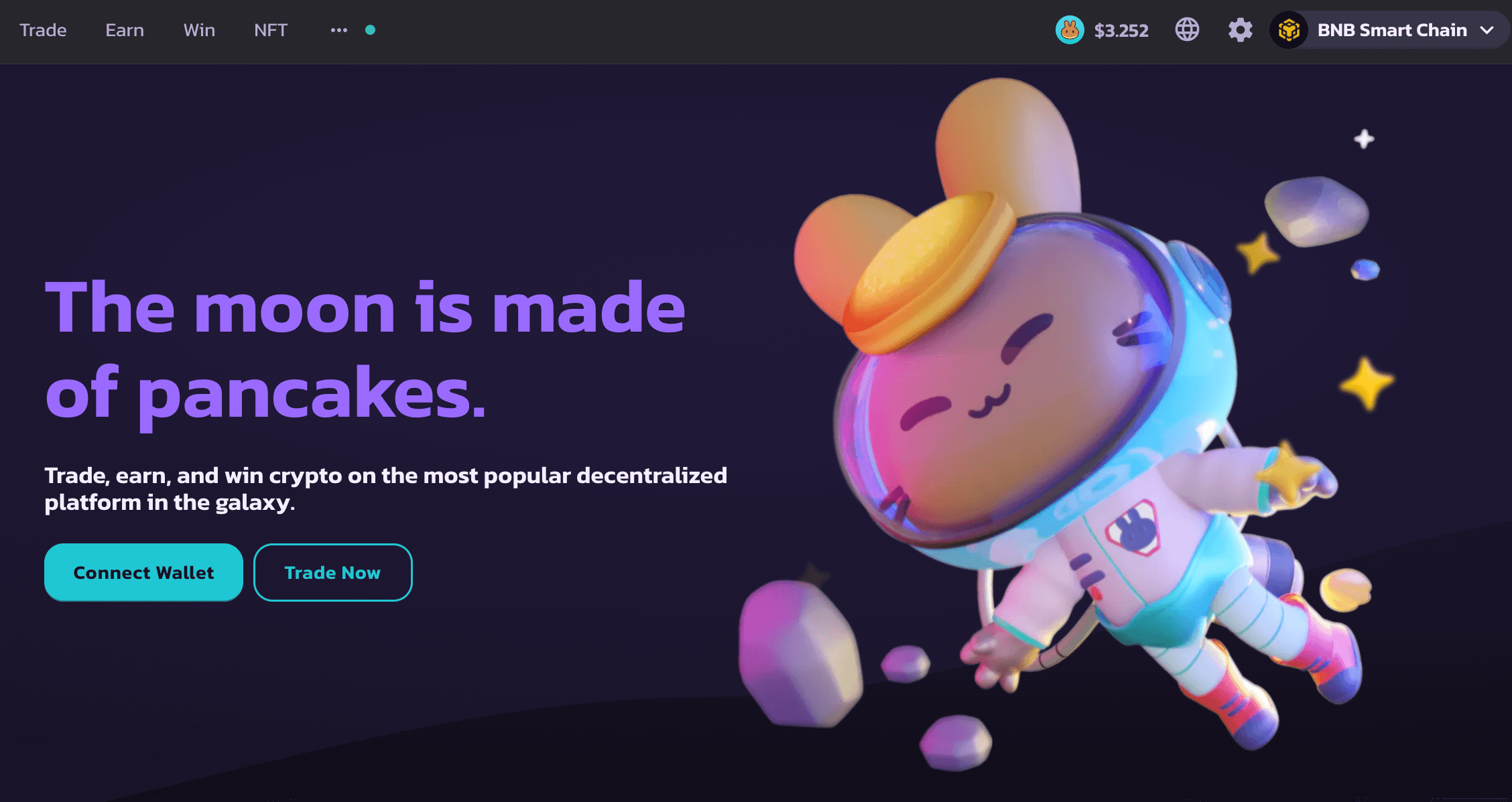

PancakeSwap

PancakeSwap seems to be the most popular exchange for finding new cryptocurrencies due to the platform’s simple listing process. This might not be “your” exchange if you prefer to invest in well-known tokens only. However, buying no-name cryptocurrencies can make you rich one day, you never know. It was built on the Binance Smart Chain, however, it has recently integrated with the Ethereum blockchain giving its users access to a bigger number of coins and more liquidity

Pros- Generous rewards including NFTs, lotteries etc.

- High daily trading volumes resulting in low slippage

Cons- No customer support

- No mobile app

-

Uniswap

UniSwap is definitely one of the biggest DEXs that run on the Ethereum blockchain. Despite being large, UniSwap offers quite low fees making it attractive to more users. Crypto enthusiasts who also stake tokens in a liquidity pool get the chance to earn additional interest. Holders of their UNI token can participate in the exchange’s governance and together make decisions on the platform’s growth plans

Pros- Low flat-rate trading fees

- Users retain custody of the coins

Cons- Fake coins are a risk since it’s easy to add new coins to the platform

- Higher-than-average fee

- Kine Protocol

Kine Protocol is one of the best DeFi Bitcoin exchanges. It offers unlimited liquidity and has a trading volume of over $260M. The platform is designed to provide users with diverse benefits that can be earned by playing and learning. Kine Protocol’s unlimited liquidity ensures that users can easily buy and sell assets without the risk of slippage or price manipulation. With a range of features and tools for experienced and novice traders, Kine Protocol is a promising option for those looking to participate in DeFi.Pros

Kine Protocol is one of the best DeFi Bitcoin exchanges. It offers unlimited liquidity and has a trading volume of over $260M. The platform is designed to provide users with diverse benefits that can be earned by playing and learning. Kine Protocol’s unlimited liquidity ensures that users can easily buy and sell assets without the risk of slippage or price manipulation. With a range of features and tools for experienced and novice traders, Kine Protocol is a promising option for those looking to participate in DeFi.Pros

- Unlimited liquidity

- Good trading volumes

Cons- KYC is required

- A limited number of coins to buy

-

Curve Finance

Curve Finance is one of the best DeFi exchanges that offers numerous benefits for crypto traders. One of its greatest strengths is its non-custodial platform, which ensures users have full control over their tokens. Additionally, Curve offers multiple liquidity pools for users to choose from, allowing them to hold their tokens over a longer term instead of trading them. As a fully decentralized platform, Curve is governed by its community using CRV tokens, giving users a voice in decision-making.

Curve Finance is one of the best DeFi exchanges that offers numerous benefits for crypto traders. One of its greatest strengths is its non-custodial platform, which ensures users have full control over their tokens. Additionally, Curve offers multiple liquidity pools for users to choose from, allowing them to hold their tokens over a longer term instead of trading them. As a fully decentralized platform, Curve is governed by its community using CRV tokens, giving users a voice in decision-making.However, Curve is heavily dependent on the Ethereum blockchain and has a challenging interface for new users, and there is no mobile app available at this time. Despite these drawbacks, Curve is an excellent choice for those seeking easy stablecoin swaps, liquidity pool management, and low slippage.Pros

- Non-custodial, you are in control of your money

- Multiple liquidity pools

Cons- Not very user-friendly

- Heavily dependent on the Ethereum blockchain

-

DODO

DODO is one of the best decentralized trading platforms, which offers a unique Proactive Market Maker algorithm, enabling efficient on-chain liquidity for Web3 assets. It allows users to trade assets cross-chain, issue their own assets, and mint and fractionalizes NFTs. DODO also offers lucrative staking and LP mechanics, making it a popular choice among experienced DeFi users. DODO is a decentralized exchange, so KYC or account verification isn’t necessary, which could be a concern for users who prioritize security and regulatory compliance. Overall, DODO offers a comprehensive range of features for DeFi enthusiasts and project developers alike.

Pros

- Unique Proactive Market Maker algorithm with efficient on-chain liquidity for Web3 assets

- Lucrative staking and LP mechanics

Cons- Smaller user base compared to more established platforms

- Being relatively new, there is some uncertainty around DODO’s long-term viability

-

Balancer

Balancer is one of the best decentralized cryptocurrency exchanges that offers an automated market maker (AMM) system for liquidity provision. It allows users to swap cryptocurrencies and create or participate in customized pools with their own weights, fees, and trading rules. Balancer also offers a range of DeFi features, including staking, liquidity provision, and governance voting. One of the advantages of a Balancer is that it enables users to earn passive income through liquidity provision, with higher fees for pools with less liquidity. However, Balancer has also faced some security concerns and hack attempts, which have led to improvements in its security measures. Overall, Balancer is a flexible and innovative DEX that has gained popularity among DeFi users.Pros

- Users can customize pools with their own rules and earn passive income

- DeFi features like staking, liquidity provision, and governance voting

Cons- Balancer has faced security concerns and hack attempts, leading to improved security measures

- Customization options may be overwhelming for new users.

- Liquidity on Balancer is lower than on more established DEXs

-

Apex Protocol

Apex Pro is a decentralized exchange (DEX) that operates on the Ethereum blockchain, allowing users to trade cryptocurrencies in a secure, transparent, and efficient manner. It boasts fast trade execution, low transaction fees, and a user-friendly interface that makes it easy for both experienced and novice users to navigate. Apex Pro also offers a wide range of DeFi features, such as staking, yield farming, and liquidity provision, allowing users to earn passive income on their holdings. However, as a relatively new DEX, Apex Pro may face challenges in attracting liquidity and building a robust user base compared to established platforms. Nonetheless, Apex Pro is one of the best decentralized crypto exchanges and a promising platform that offers a compelling value proposition for DeFi enthusiasts.Pros

- Fast trade execution and low transaction fees

- A range of DeFi features, such as staking, yield farming, and liquidity provision

Cons- Smaller range of trading pairs compared to more established DEXs

- Limited security measures in place compared to more established DEXs

How do I trade in DEX? Appreciating the beauty of no-frill decentralized platforms

Why are people choosing decentralized exchanges these days? Mostly to be in control of their assets and make sure that guys like SBF won’t mess with their money. However, another big plus of DEXs is their anonymity – you will not have to sign up and go through any verifications which is a bliss compared to KYC circles of hell on the centralized platforms.

Here’s an example of simple start on a decentralized platform:

- Connect your wallet (MetaMask or Binance) to the exchange

- Deposit funds to start trading

- Buy and sell derivatives

- Track your position to ensure the most profitable deal

Since crypto derivatives trading is quite risky, a great way to get the hang of trading crypto derivatives on a DEX is to try the Testnet version to get a risk-free experience of the process and get ready for the first profitable deal.

Final thoughts on choosing the best crypto exchange

When choosing a crypto exchange, there are a few things to keep in mind. First and foremost, security is key. Make sure to choose an exchange the best crypto exchange USA that has a good reputation and is well-encrypted. Secondly, fees can vary widely from one exchange to another, so be sure to compare and find the best option for you. Finally, consider the geographical restrictions of the exchanges you’re considering; some only operate in certain countries or regions. With all of these factors in mind, you should be able to find the best crypto exchange for your needs.

FAQ

What is the best crypto exchange no KYC?

Some decentralized exchanges that operate without KYC are Dexilon, PancakeSwap, Uniswap, and SushiSwap.

Decentralized exchanges rely on the transparency and security of blockchain technology to facilitate transactions without the need for a centralized authority to oversee them. This means that users can trade cryptocurrencies peer-to-peer without providing personal identification information.

Overall, the best cryptocurrency exchange with no KYC requirements will depend on individual preferences and needs.

Which exchange is best for cryptocurrency?

DEX platforms are becoming popular due to their decentralized, transparent, and secure nature. DEX offers benefits like privacy, no KYC, and lower fees compared to centralized exchanges.

Some popular DEX options are Dexilon, Uniswap, Sushiswap, PancakeSwap, and Curve Finance.

Dexilon is an emerging DEX platform that offers decentralization, transparency, security, and low fees through smart contracts. Due to its flexibility and commitment to security and transparency, it’s already considered the best exchange for cryptocurrency by many traders.

What is the safest crypto exchange?

Delixon is already considered the safest crypto exchange by a lot of traders due to its robust security system that ensures the safety of users’ funds and personal information. Being committed to security, Dexilon completed the security audit conducted by Hacken, a cybersecurity company that helps businesses protect themselves from online threats.

Dexilon is a decentralized exchange, which means that there is no central authority controlling the platform. This reduces the risk of hacking attacks or fraud that can occur on centralized exchanges that store user funds in a centralized location. You are in charge of your funds, not Dexilon.

Dexilon uses smart contracts to facilitate trades, eliminating the need for intermediaries and reducing the risk of human error or manipulation.

All transactions on Dexilon are transparent and publicly visible on the blockchain, providing an added layer of security and ensuring no room for fraudulent activities.

What is the lowest fee crypto exchange?

Dexilon is an excellent option for traders looking for lower fees. As a decentralized exchange, Dexilon uses smart contracts to facilitate trades, which eliminates the need for centralized authority and reduces overhead costs. This allows Dexilon to charge lower fees compared to centralized exchanges. Dexilon is one of the lowest fee crypto exchanges because of 0 gas cost and great rebates for both maker and taker fees.