Easy come, easy go: the fall of FTX and what it means for the crypto market

17, November, 2022 • Maxym AptilonThere are few crypto folks left who haven’t heard anything about the FTX collapse in the past couple of days. The trust in crypto has shaken leading to multiple crypto assets dropping in price. And here they come again – crypto naysayers telling us again that crypto is just a big scam. Is that so? Let’s take a look at the facts and figure out if the notorious FTX story unfolding right now means that crypto is doomed (If you don’t have time to read the whole post, here’s the summary: NO).

What happened and why the crypto market looks like the city after the earthquake?

FTX, that used to be one of the biggest players in the crypto market, became insolvent in just a few days dragging the whole crypto market down with prices of tokens sinking drastically. But what happened? Here’s the recap.

Backstory

Binance used to be FTX’s early investor in 2019. Back then, CZ and SBF looked like bros that help and support each other. But then they suddenly broke up in 2021 when FTX bought out Binance’s remaining shares in the company. Binance received a big share of ~$2.1b in FTT (FTX’s token) and since then they became “somebody that I used to know” for each other and their CEOs never missed a chance to take shots at each other.

Escalation

Last Recently, Coindesk has published an article about Alameda research, SBF’s trading company revealing that Alameda research holds $14b in assets and $8b are liabilities. What was shocking, $8b out of $14b were FTT holdings and a few billions worth of Solana. Obviously, nobody else could provide such a loan using FTT collateral apart from FTX (the exchange holds the biggest share of FTT). CZ figured out that FTX’s position is shaky, and made his blow by announcing an intention to sell off his FTT holdings. Thus, destroying the value of a collateral and putting Alameda at a margin call. CZ’s twit was enough for FTT to drop by 35% overnight! People started panicking and tried to get rid of FTT, but nobody was there to buy.

Soon, it became obvious to the public that FTX is at risk, so people started taking money out of FTX. At some point, the exchange couldn’t facilitate users’ requests due to the shortage of liquidity. Just when people calmed down a bit and the withdrawals slowed down, Binance informed that they intended to buy FTX “to save them.” However, in less than a day, we find out that Binance backed up on buying FTX: “Binance is strongly leaning toward scrapping FTX rescue takeover after first glance at books.”

Conclusion

FTX was worth $30b just a few months ago… and now, out of the blue, it’s insolvent. There are still many details to be discovered, but we know one thing for sure: FTT, the FTX’s token, was inappropriately used as collateral to borrow against As a result, FTX reportedly ended up with a $10b hole in its balance sheet with the SEC and the Department of Justice investigating the case. Apparently, FTX has suspended all the withdrawals and the onboarding of new clients.

What are the consequences?

No wonder we see quite devastating aftermath in the past days of the unfolding FTX drama (and we expect the ripple effect to last for a while):

- Cryptocurrency prices started sinking like stones: BTC: -16.1%, ETH: -24.1%, MATIC: -26.9%, SOL: -43.0%.

- Owing $8-12b to their users, FTX tried to raise money for liquidity. No wonder they haven’t been able to do it – with such bad reputation, they’re hardly worth that much. So FTX, FTX group (130 affiliated companies), and Alameda Research have all started filing for bankruptcy on Friday. The whole FTX Ventures team quit, including the CEO.

- Uncertainty also hangs over Solana, like the sword of Damocles: it relies heavily on FTX for its value. Now when the exchange is going down, it is unknown whether bitcoins traded on the blockchain will be retrievable.

- Galaxy disclosed they lost $76M, and Genesis Trading reported a $175m loss.

- Sam, FTX’s CEO, also owns 10% of Robinhood, so we might be seeing some consequences for the company as well.

- On late Friday, FTX reported that they have been hacked losing about $600m. It is rumored that someone from the management took the money, especially due to the fact that “hackers” allegedly had access to both website and apps.

The centralized crypto world has been having rough times this week. CZ reportedly wrote an email to the Binance team saying that he’s not happy at all about FTX going down, since what happened will affect the whole market. But let’s take a look at what it can mean to the DeFi share of the market.

How different are DEXs, and why are they immune to such issues?

A centralized exchange is a blackbox – its users can see only the data that exchange wants them to see. What’s more, despite the increased levels of security, big centralized exchanges are at risk of being hacked, too. You can deposit your money to a wallet, buy some crypto and wake up to see your wallet balance show up as $0 one day, like FTX users on Saturday.

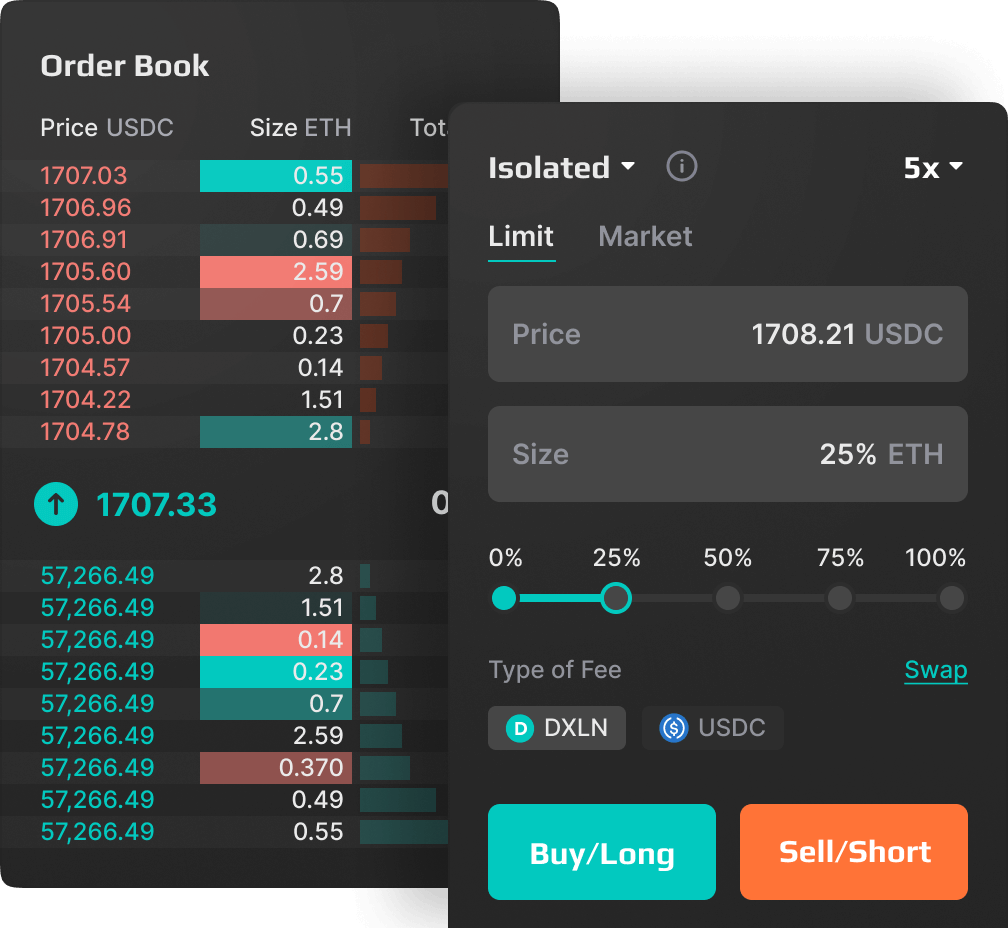

In its nature, decentralized exchanges are far more transparent than centralized exchanges. A DEX can’t misuse your money because they won’t have access to it. Thus, one of the biggest advantages of DEXs is their self-custody that allows you to be in possession of your assets. With an exchange like Dexilon, you will have full control over your funds. You will be depositing your assets to the smart contract, thus, they will not be stored on the platform and can’t be secretly used by the exchange for its own purposes.

As for the security, decentralized exchanges can also be hacked, just like traditional ones. However, the level of safety depends on the measures taken by the platform individually. For example, Dexilon is currently under auditing of a top tier security firm called Hacken. Dexilon is designed to be as fast and efficient as top centralized exchanges, but when using Dexilon, users can be confident in the exchange’s solvency.

Centralized exchanges usually sell off users’ positions using their own algorithms, or outsource this process. Obviously, this is not transparent.

In the crypto winter, things have been rough already, with prices dropping and companies laying down employees, and it is expected that it’ll last a little longer than expected because of this incident. But rough times like these are also the best times to build. If you believe in crypto no matter how raging the storm is and will make wise decisions, you can rise high on the next wave. It definitely takes time to find the best practices, so use the situations like this to learn from others’ mistakes.

UPDATE (November 25/2022)

As another week passes, we get more details about the notorious FTX case and its impact on the crypto market. Let’s take a look at several facts we’ve learned about it since last week:

- FTX’s balance sheet that SBF sent to the potential investors was leaked showing ~ $9 billion in liabilities and over $1 billion in liquid crypto assets. Also, $5.4 billion in assets were labeled as “less liquid” and $3.2 billion were called “illiquid”. Thus, FTX’s accounting was either poorly executed or fraudulent. While the total amount of liquid and “less liquid” assets is still not equal to liabilities, many of the “less liquid assets” can turn out to be totally illiquid.

- Last week FTX’s 30-page bankruptcy filing was released. Here are some of the highlights: FTX didn’t have any cash management and customer deposit records. What’s more, they used software to hide the misuse of their users’ funds. They didn’t have any employee records, nor did they have any board meetings. FTX created a “secret exemption” for Alameda to bypass the auto-liquidation protocol in the platform.

- Given all the turmoil around Genesis and Grayscale, Barry Silbert, founder, and CEO of DCG wrote a note to the shareholders trying to calm them down. The investors’ unrest was caused by the Wall Street Journal’s report that Genesis has been trying to raise $1b before suspending some withdrawals. There were reports claiming that Genesis was about to file for bankruptcy. However, the company refuted the claims.

- Trading volumes on decentralized exchanges grew by 11% since the FTX fall. Twitter is full of statements about the importance of DeFi. For instance, Pascal Gauthier, CEO of Ledger, said that “the message is clear: people are realizing that we must return to decentralization and to self-custody.”

Overall, the case proves that what happened wasn’t a crypto issue. Rather, it was a corruption issue. In this case, we can’t blame crypto or the blockchain because it was a con man who used crypto to trick people and steal their money. That’s why the cryptocurrency market is still there and people are still trading crypto coins, while many of them are turning their heads towards DeFi.