Crypto derivatives have become an inalienable part of the crypto market in recent years. Similarly to the stock market, crypto derivatives can be a great way to speculate on the cryptocurrency’s price or mitigate the losses by hedging.

Choosing the best crypto derivatives trading platform is as important as picking the crypto asset – it can make you rich or broke, depending on the changes in the volatile crypto market. The end-of-2022 FTX drama has shown that investing in profitable cryptocurrency on an unreliable exchange can result in the loss of your earnings. Finding the best exchange to trade cryptocurrency easy since plenty of centralized and decentralized exchanges already support this service. However, it’s not as simple as it looks at first glance. This post discusses the most trusted exchanges worldwide and highlights their vital features. Ultimately, it’s you who makes a decision.

Trading in the derivatives market is riskier and requires more advanced skills than spot trading. Leverage allows you to amplify your earnings tremendously. However, it can also result in much more significant losses than you would have if you just traded with the money at your disposal. Along with the skills and knowledge, finding the best derivatives exchange that will both be safe and give you the resources you need to open up your full trading potential is essential.

Best crypto derivatives exchanges in 2023 – choose a reliable friend for your cryptocurrency journey

2022 has been rough for crypto, and everyone expects that the 2023 market will still be impacted heavily by everything that happened in the past 12 months. However, some exchanges are doing better than others, especially decentralized ones. Here’s a brief review of the 10 great crypto derivative platforms you can choose from to start (or continue) your crypto journey.

List of TOP cryptocurrency derivatives exchanges

Dexilon

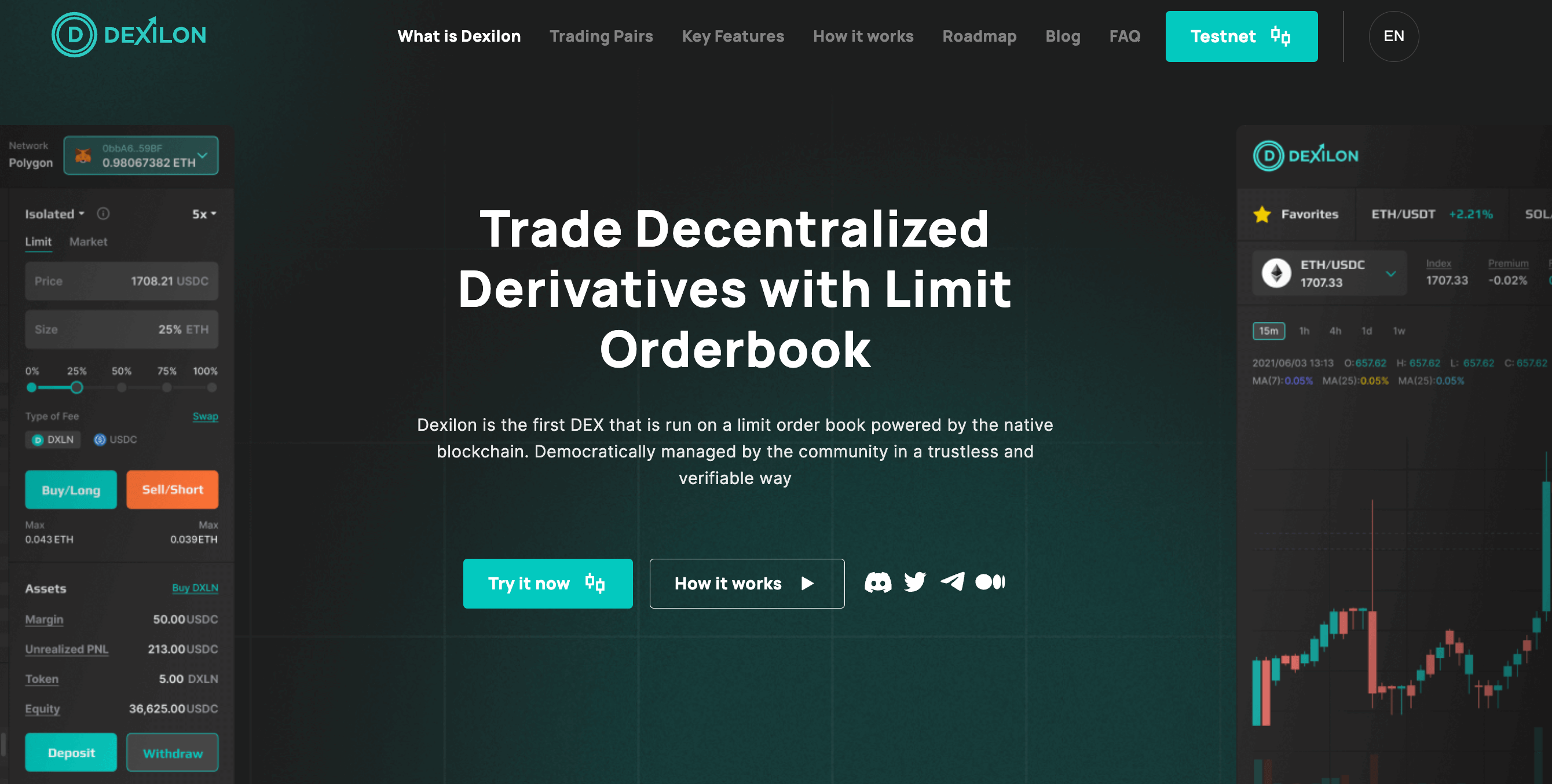

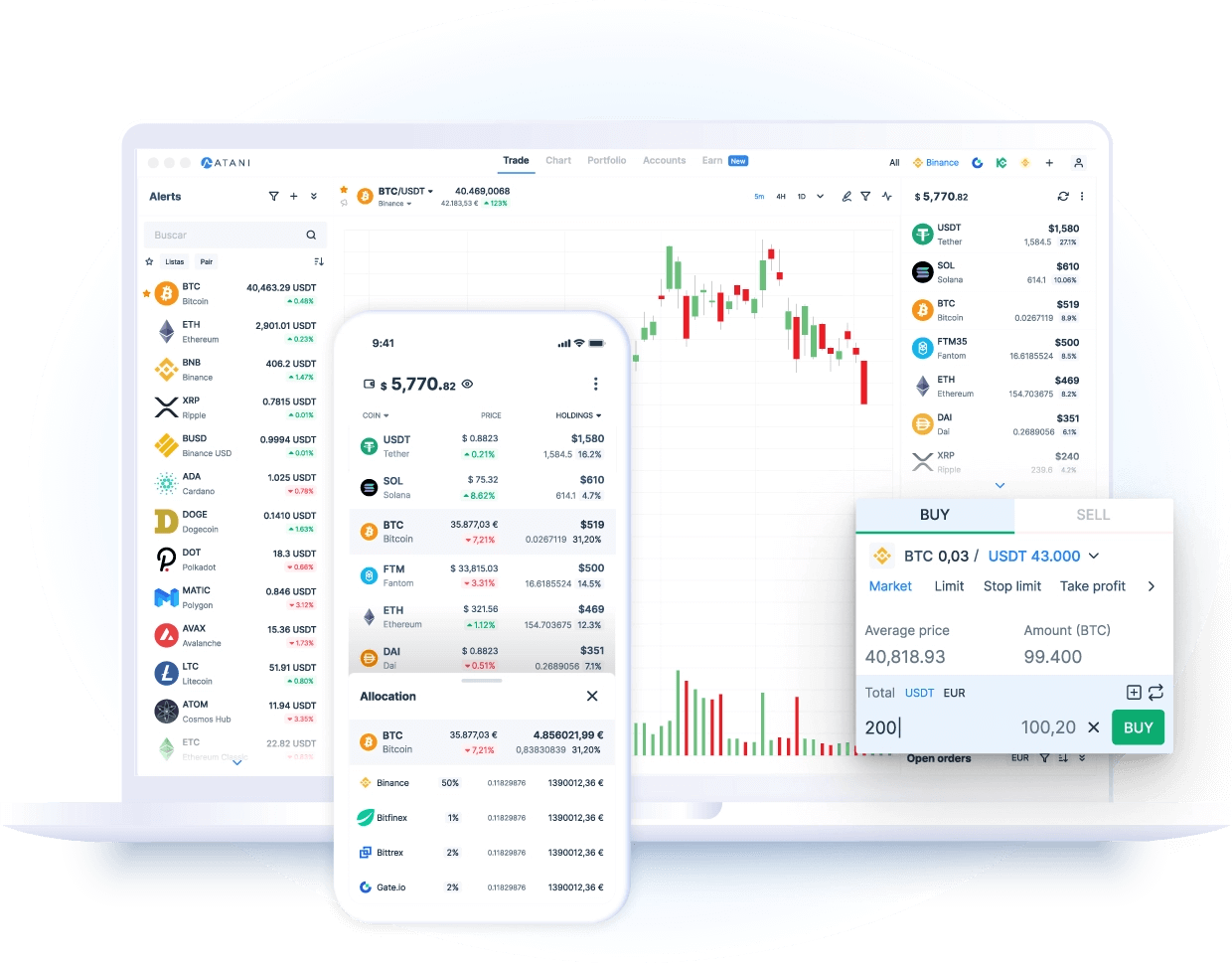

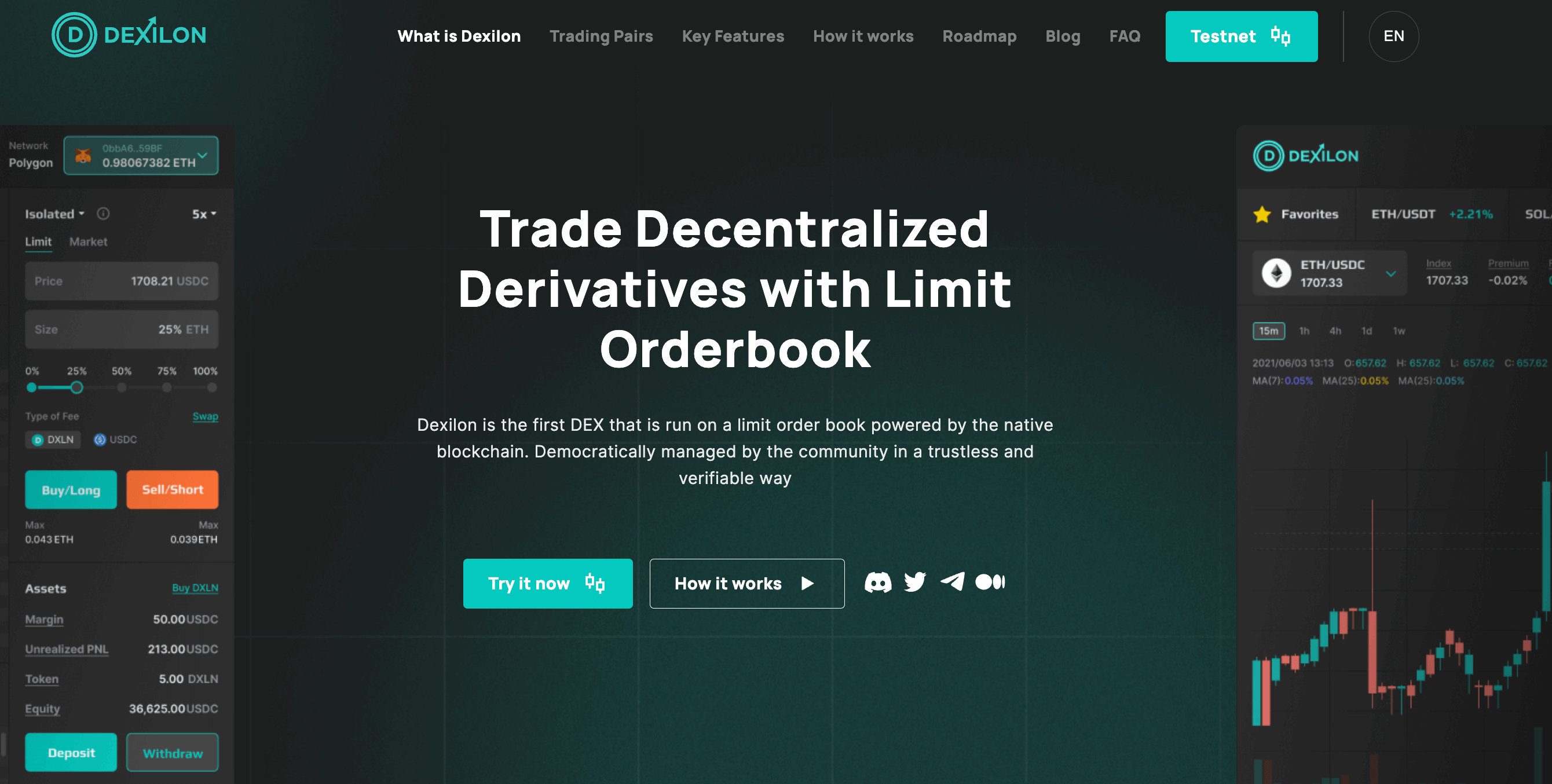

Dexilon is already one of the best cryptocurrency derivatives exchanges even though it has been in the crypto market for less than 2 years. Being a decentralized platform, Dexilon can offer the benefits of the CEXs, like low latency order execution. Dexilon users aren’t paying any gas costs, which makes their low fees even more compelling. With this best crypto derivatives exchange, users are in charge of their assets without worrying about their funds being misused. What is also appealing about Dexilon is their UX – simple and straightforward trading process as well as clear dashboards, which makes it accessible for beginners. Also, their Testnet allows crypto newbies to learn how to trade the best crypto derivatives tokens risk-free.

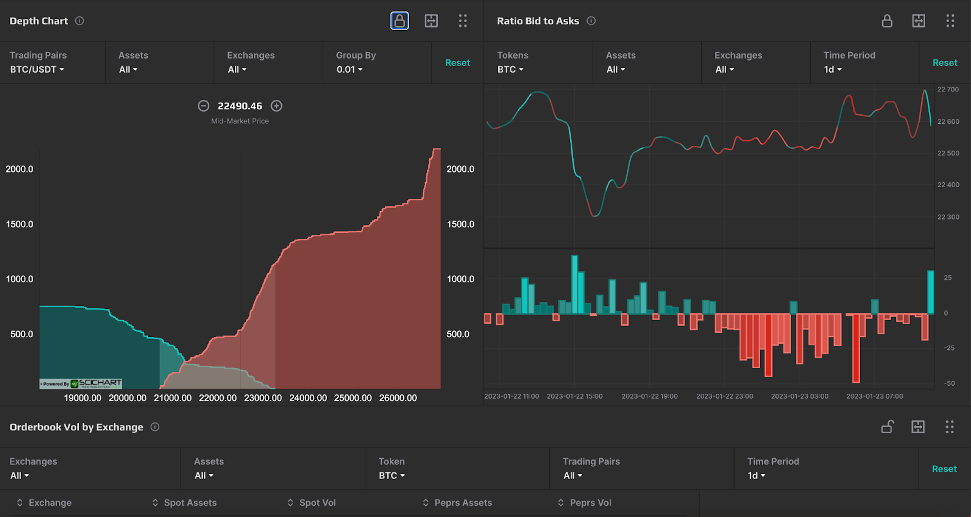

As for the roadmap, the Dexilon team is building a cutting-edge data terminal to allow users to make informed trading decisions.

Pros

- Robust security combined with anonymous trading

- Self-custody – user is in charge of their money

- Wide range of derivatives to choose from

Cons

- A relatively short list of coin pairs to trade

Binance

Binance has been on the market for a while and has a vast user base. Binance Futures went live in 2019 and, since then, changed the dynamics of the crypto derivatives industry. The bitcoin derivatives exchange offers USDT-margined perpetual futures, COIN-margined perpetual and traditional futures, leveraged tokens, and BTC options. Trading fees depend on your trading volumes within the past 30 days. The maker fee is 0.02% for the initial level, and the taker fee is 0.07%. However, there are some discounts when paid with BNB.

Pros

- High trading volume and liquidity

- Fiat currencies available

Cons

- Trading is possible by depositing USDT only

KuCoin

KuCoin is a significant cryptocurrency derivatives platform that operates in 200+ countries. In addition to the basic features, the platform offers futures, margin, and P2P trading. KuCoin also allows users to trade with the mobile app, available both for Android and iOS. The trading fees range from 0.01% to 0.1%, which is relatively low compared to the market average. However, the exchange also charges withdrawal fees that vary by the asset. The platform was hacked in 2020, and since then, it’s developed robust security features to ensure this doesn’t happen again.

Pros

- A variety of crypto assets

- Low fees

Cons

- Low trading volumes

- Many poor user reviews

BTCEX

With BTCEX, you get access to 70+ cryptocurrencies and a great variety of features. Users can access perpetual markets, futures, and options besides spot trading. The platform offers 10x leverage, which might need to be more impressive for seasoned traders. However, if you’re a beginner, you should remember that the bigger the power, the higher the risk of losing money. The signup process is straightforward and takes less than a minute, a big plus compared to popular centralized platforms.

Pros

- Mobile app for iOS and Android

- Beginner-friendly platform with guiding materials

Cons

- Deposits and withdrawals in crypto only

- No quick buying and selling of cryptocurrency

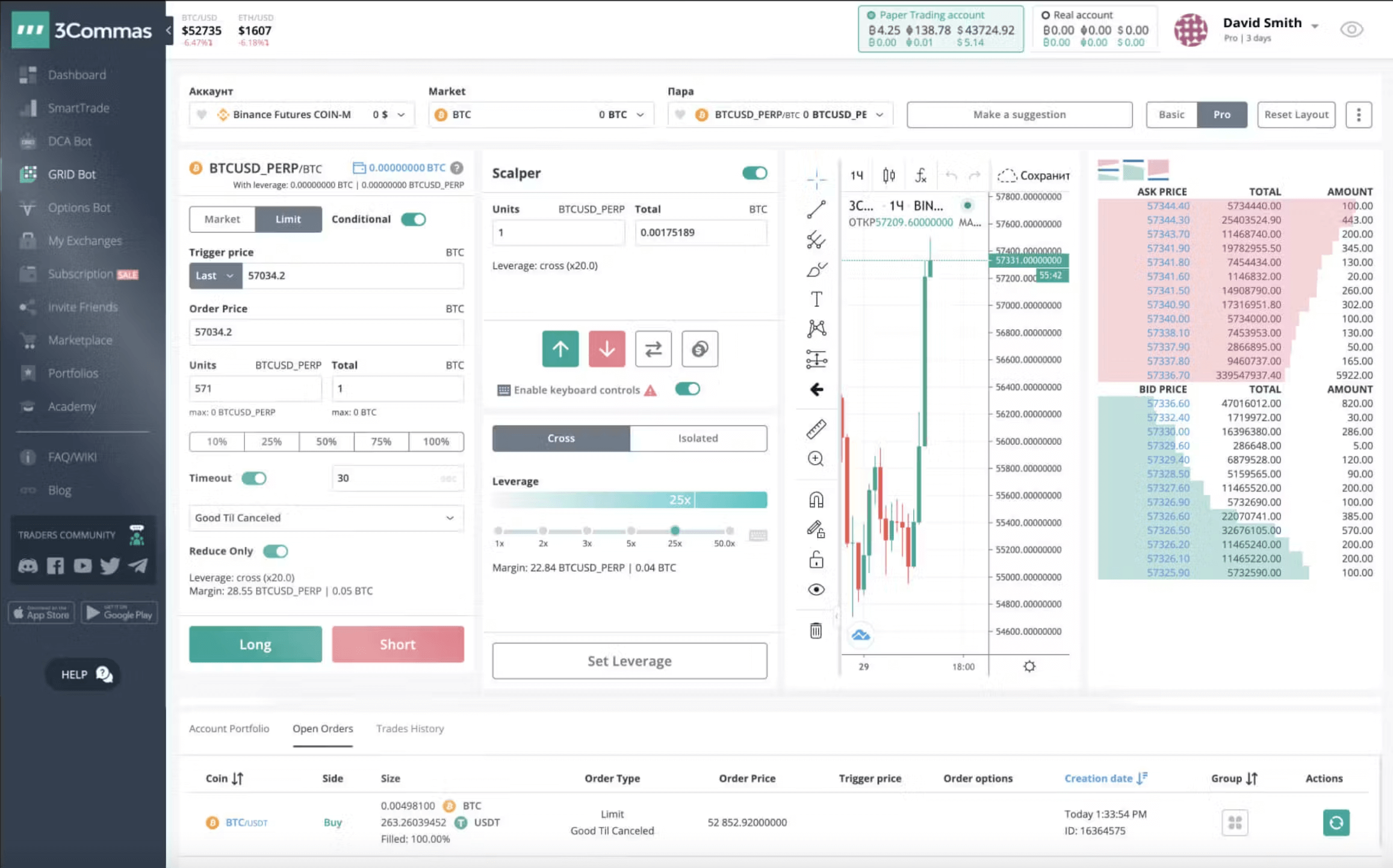

Bybit

Bybit is one of the best crypto derivatives exchanges that has been on the market since 2018. It’s a platform that focuses on crypto derivatives only. Some of their significant derivatives products include USD margin perpetual, Coin margined inverse perpetual, and Coin margined inverse futures. As for the fees, they’re pretty pocket-friendly – 0.075% are charged from the taker. The maker, however, will get a 0.025% reward for the trade. The exchange is claimed to process up to 100K transactions per second, making it convenient for individuals and institutions.

Pros

- Low minimum deposit requirements

- Demo account

Cons

- Not the best option for beginners

- A limited number of trading pairs

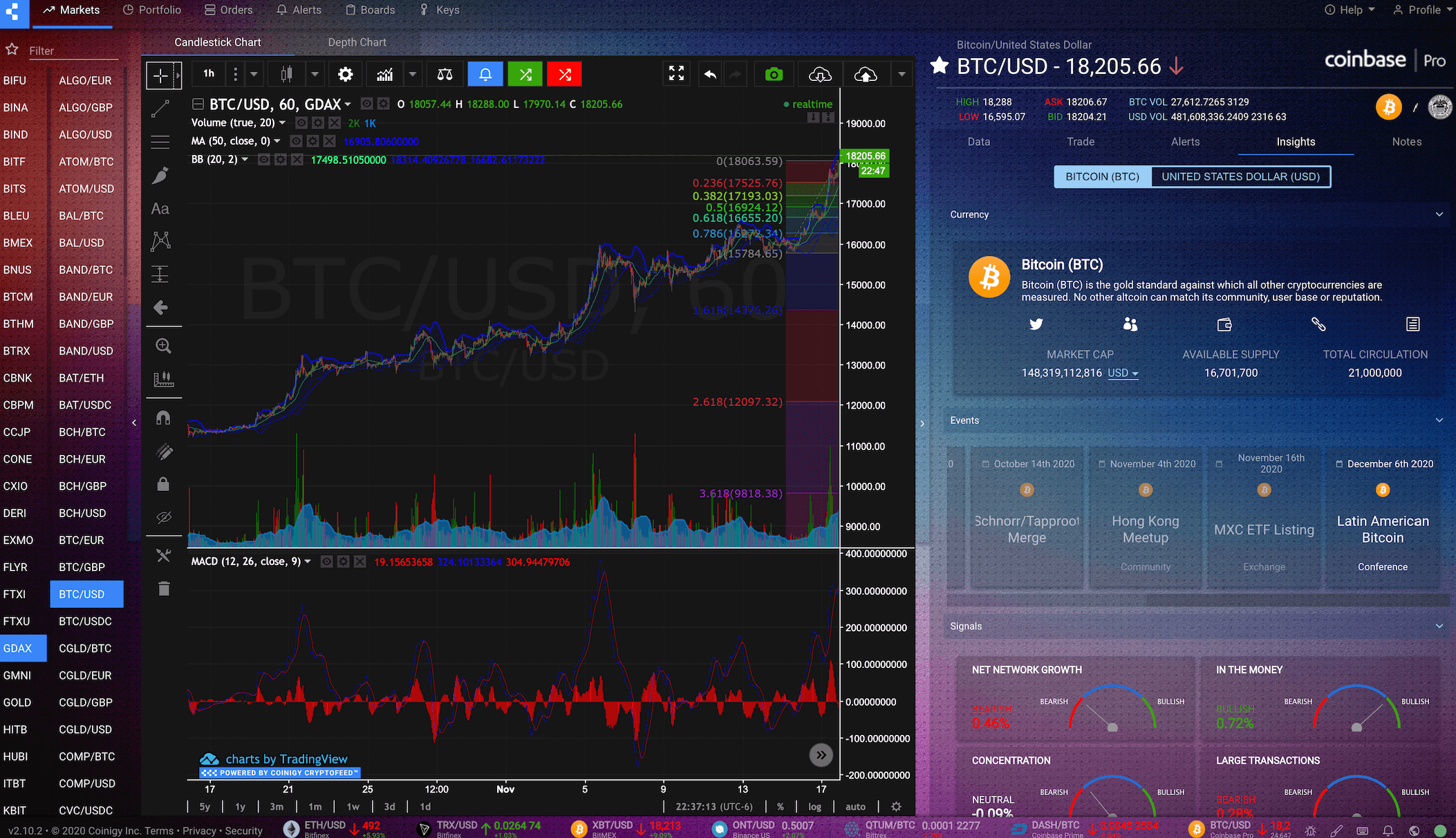

Deribit

Deribit has been specializing in crypto futures and options since 2016. It is a decentralized derivatives exchange available in more than 100 countries. One of the great things about Deribit is that both deposits and withdrawals are free of charge, depending on the amount. It’s not a decisive factor, but isn’t it heavenly when you don’t have to pay any fees and can just withdraw your rewards? The exchange supports Bitcoin derivatives and Ethereum derivatives only. Deribit also has mobile apps for both Android and iOS. A strong plus of the platform is its analytics tools for tracking indexes, volatility, etc., and dashboards to follow trading history and order books easily.

Pros

- No fees for deposits and withdrawals

- Great leverage for futures (100x for BTC and 50x for ETH)

Cons

- Lengthy KYC process

- Supports only BTC and ETH

Huobi Global

Huobi Global is famous for its excellent liquidity and solid trading crypto derivative volumes in the derivatives market. The exchange offers the following products: futures, coin-margined swaps, USDT-margined swaps, and options. They can either be utilized to maximize your yield or for hedging to ensure you secure some of your investments. The fees on the platform vary depending on the type of product you go for. Here are a couple of examples:

Futures: 0.02% maker and 0.04% taker

Coin margined swaps: 0.02% maker and 0.05% taker

Pros

- Over 230 assets to trade

- Good level of security

Cons

- Low withdrawal limits

- Low leverage for margin

- Long signup process

The ‘pros and cons sections are essential for you to quickly grasp why you should or should not choose a platform. Below we described the criteria for you to consider when researching the crypto platforms and selecting the best one for you.

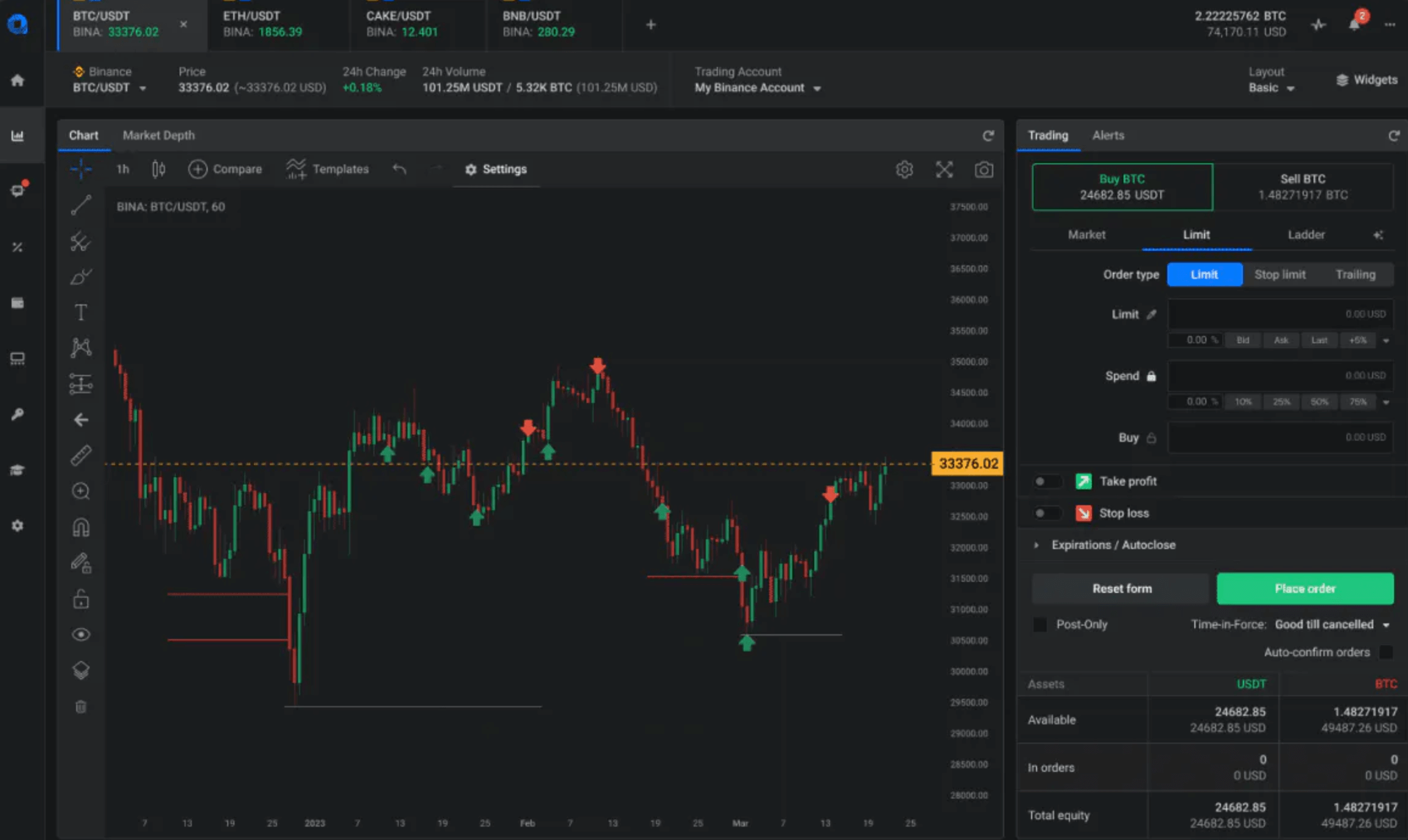

OKX

OKX is a leading cryptocurrency exchange operating globally, serving users in more than 150 countries. The platform provides a wide range of features and services including leveraged trading, token sales, ability to trade crypto derivatives using futures contracts. OKX is available for both Android and iOS devices. The trading platform maintains a competitive fee structure, with trading fees ranging from 0.05% to 0.15% depending on the trading volume and asset type. The exchange employs industry-leading measures to safeguard user funds and personal information.

Pros

- Wide range of advanced trading features

- User-friendly mobile application

- Competitive fee structure with incentives for traders

- Strong security measures to protect user assets

Cons

- Limited availability of certain cryptocurrencies

- Customer support response time can be slow during peak periods

Bitget

Bitget is a prominent global derivatives exchange that operates in multiple countries, offering advanced trading options such as futures trading, leverage trading, and contract trading. The platform offers a user-friendly mobile application available for both Android and iOS devices. Bitget boasts a competitive fee structure. The platform charges low trading fees, with rates ranging from 0.03% to 0.1%. Moreover, this derivatives exchange provides fee discounts and incentives for active traders, enhancing their overall trading experience.

Pros

- User-friendly mobile application for on-the-go trading

- Fee discounts for active traders

- Strong security measures

Cons

- Limited selection of cryptocurrencies compared to some other exchanges.

- Some users have reported occasional delays in customer support response time.

Bitget provides users with a reliable platform to engage in cryptocurrency trading with confidence.

Gate.io

Gate.io is a cryptocurrency derivatives platform praised for its user-friendly interface and intuitive trading platform, making it accessible to both beginners and experienced traders. The derivatives exchange platform also provides a mobile application for convenient trading on the go, which has received positive feedback for its ease of use and functionality.

Gate.io implements a competitive fee structure, with trading fees ranging from 0.1% to 0.2%. While some users have expressed concerns about customer support, Gate.io prioritizes security and implements measures to protect user funds and personal information.

Pros

- A diverse selection of cryptocurrencies for trading.

- User-friendly interface and intuitive trading platform.

- Convenient mobile application for trading on the go.

Cons

- Occasional delays in customer support responses.

Mixed reviews regarding trading fees, which some users find high for certain trading pairs or volumes.

Which crypto exchange is best for derivatives – consider the 5 criteria below

There are various factors to consider while choosing the top crypto derivatives exchange, and some of them might be more of a priority for you, while others are insignificant. We decided on 5 main criteria to lean on while looking for a decent cryptocurrency derivatives exchange:

- Security and insurance. No doubt, this should be the first factor to consider. What is the point in choosing an exchange with 100x leverage that can’t secure your funds? You can earn thousands of dollars, but if there’s a risk that you can lose both the winnings and invested money, is it worth investing in such an exchange? People have become more interested in DEXs because of their self-custody and anonymous trading.

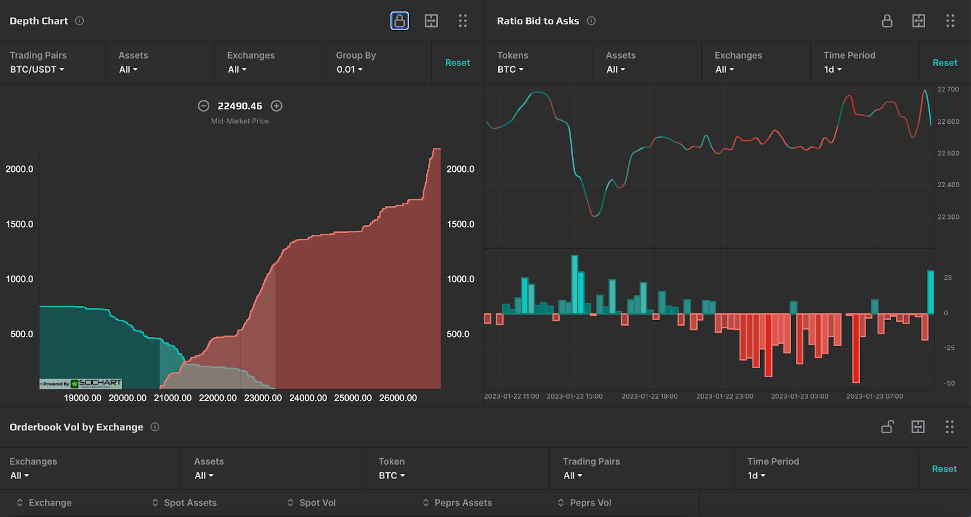

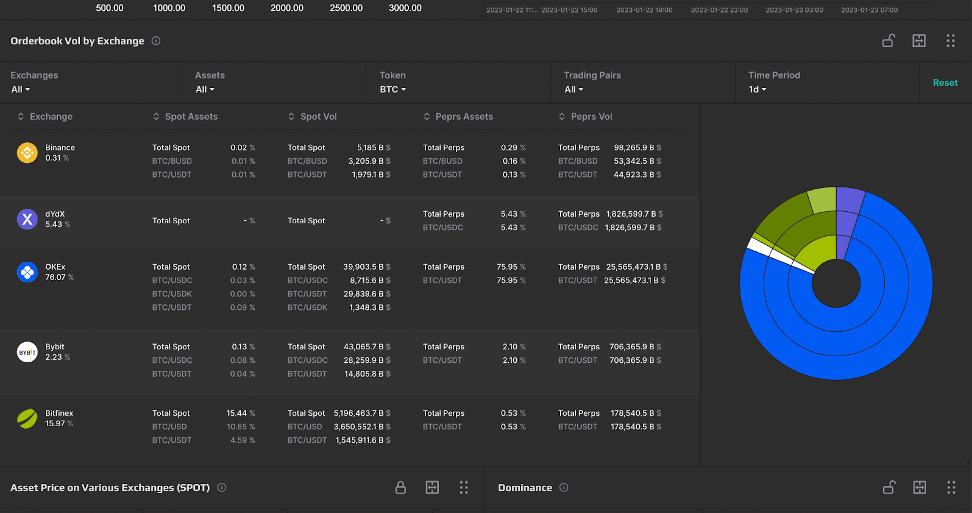

- Liquidity and trading volumes. A liquid market is associated with less risk and lower transaction costs. In a liquid market, a seller quickly finds a buyer without cutting the coin price to get a deal. Conversely, a buyer won’t need to pay more to ensure they get the asset.

- Fees. With cryptocurrency exchanges, trading fees are usually known as ‘taker’ and ‘maker’ ones. Taker fees are more expensive than the maker ones because the orders they are charged for are executed immediately, removing the order book’s liquidity. On the contrary, you pay a maker fee when you place a limit order and add liquidity to the order book. That’s why the maker fee is lower. As you gain more experience in crypto derivatives trading, you can develop some trading strategies to get rebates provided by the exchanges. For example, Dexilon gives a 0.1% rebate for makers and 0.05% for taker fees.

- Leverage. Many crypto enthusiasts find the derivatives market compelling because of leverage. What is the benefit of it? With leverage, you will be able to increase your trading volumes substantially and trade with more money than you actually have. For example, with Dexilon’s 10x leverage, you can open a position worth $10,000 while investing only $1,000.

- Technology and features. Even though it’s one of the last things users usually think about, you should not overlook the technology, since it will impact your trading experience. Poor technology doesn’t simply mean that you will sit and wait a little longer – it might also mean losing money.

- You want to choose a platform that offers a wide range of products so that you can try different ways of earning crypto without jumping between the platforms. However, as a beginner trader, you should beware of getting lost in the numerous features some platforms offer and stick to the core ones.

Some other essential criteria might be user experience, customer support, and community. Even though they don’t play a vital role in the trading experience, they are also quite important in some cases. If you’re entirely new to crypto and unsure if you can assess the exchanges based on the above factors, you can read some expert reviews for a deeper dive.

FAQ

- What are crypto derivatives?

Crypto derivatives are financial contracts that derive their value from underlying cryptocurrencies. They allow traders to speculate on the price movement of cryptocurrencies without owning the actual assets. Examples of crypto derivatives include futures contracts, options contracts, and perpetual swaps.

- How to trade crypto derivatives?

To trade crypto derivatives, you typically need to open an account with a cryptocurrency exchange that supports derivative trading. Once you have an account, you can select the desired derivative instrument, such as futures or options, and specify your trading parameters, including the contract size, duration, and leverage. It’s essential to understand the risks associated with trading crypto derivatives and have a solid understanding of the market before engaging in such trades.

- What is the best crypto exchange for derivatives?

The choice of the best crypto derivative exchange depends on several factors, including the trader’s specific requirements and preferences. Among the top cryptocurrency derivatives exchanges known for their robust derivatives offerings there are Dexilon, Binance, BitMEX, Bybit, and Deribit. These exchanges offer a variety of derivative products, competitive trading fees, liquidity, and user-friendly interfaces. It is advisable to conduct thorough research, compare features, and consider factors such as security, reputation, and available trading pairs before selecting an exchange for crypto derivatives trading.

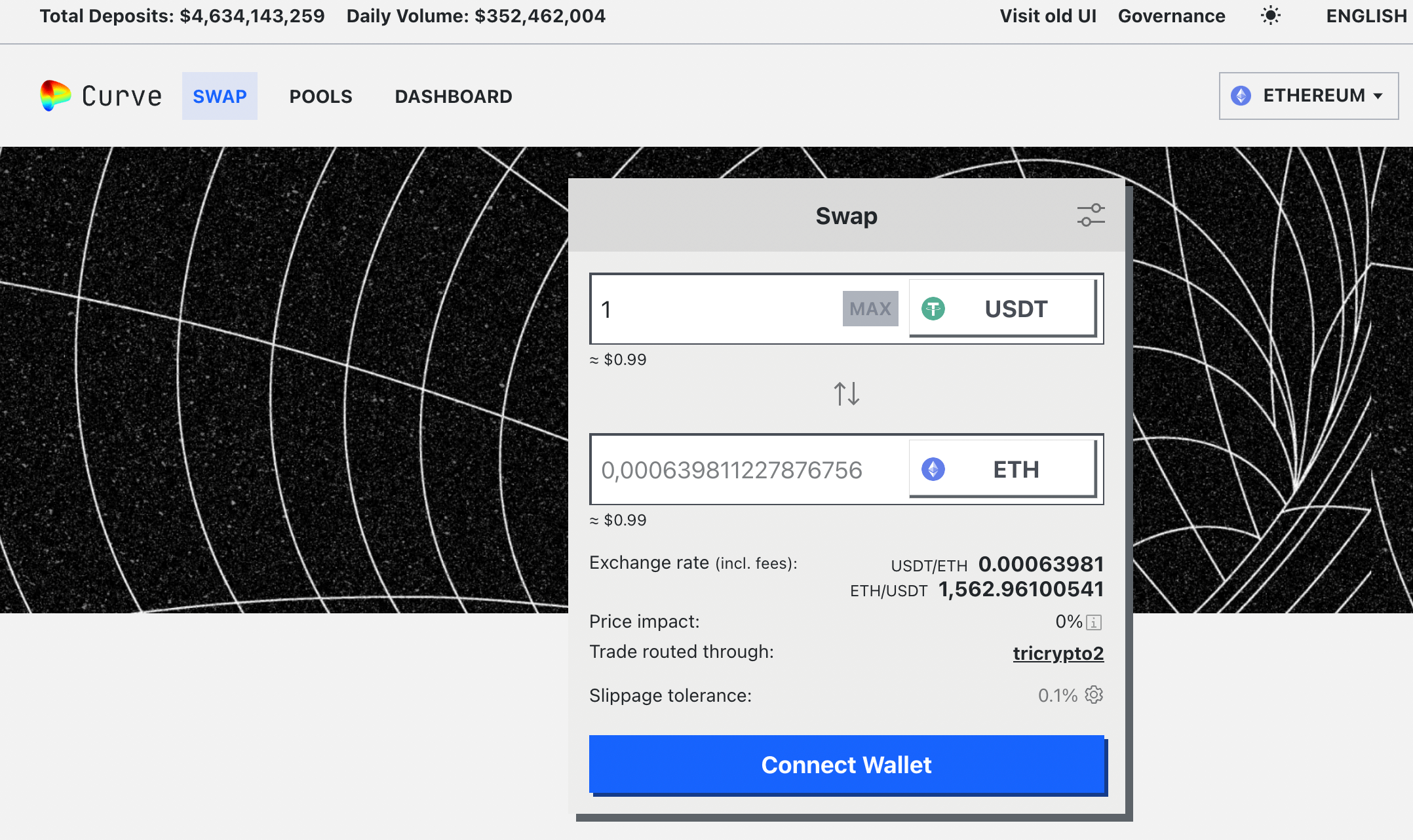

Curve Finance is one of the best DeFi exchanges that offers numerous benefits for crypto traders. One of its greatest strengths is its non-custodial platform, which ensures users have full control over their tokens. Additionally, Curve offers multiple liquidity pools for users to choose from, allowing them to hold their tokens over a longer term instead of trading them. As a fully decentralized platform, Curve is governed by its community using CRV tokens, giving users a voice in decision-making.

Curve Finance is one of the best DeFi exchanges that offers numerous benefits for crypto traders. One of its greatest strengths is its non-custodial platform, which ensures users have full control over their tokens. Additionally, Curve offers multiple liquidity pools for users to choose from, allowing them to hold their tokens over a longer term instead of trading them. As a fully decentralized platform, Curve is governed by its community using CRV tokens, giving users a voice in decision-making.